Michal Smida, the founder and CEO of Twisto was a guest on our podcast series Inside the Vacuum and had an exciting conversation with Marcel Klimo around building the next generation of financial services.

Michal spent 11 years abroad living in the US, Russia, and then London. During this time he worked in investment banking for almost four years. Michal always wanted to start his own company. When he saw how Klarna and Paypal were revolutionizing the Western market, he had the vision to bring a similar solution to the Central and Eastern European region.

From the mid-2013’s, Twisto’s initial business model focused on B2B collaborations, integrating with big eCommerce merchants. Their shift to a more customer centric company happened around 2015-2016. The name says it all; they are twisting up the way people pay daily, changing the dynamics of personal purchases.

Playing the local game.

The team of Twisto is operating in the Czech Republic, Poland, Slovakia, and expanding its business to Romania soon. The mission is to deliver the best daily payments experience possible: super secure one-click payments online with virtual cards and a flexible buy now pay later system.

What differentiates them from the competition in the region is that every transaction is with Twisto money. Twisto provides its users’ money from the very beginning and it also gives them the freedom to control how they pay for their purchases retrospectively.

[cta_to_website]

If you say ‘credit card’ in the CEE region, you will probably be met with resistance, as it is sometimes equal to ‘not having money.’ For this reason, Twisto is positioned more like a daily payments wallet, where credit is a cool feature of the app that speeds up the customer onboarding process.

‘Is it like a supercharged credit card in terms of the daily operations that people would do with it?’ – Marcel

‘Yes, it is a credit card on steroids in simple words.’ – Michal.

Michal explained that compared to other continents and regions, the customer risk is considered very high in the CEE market, where consumers are culturally searching for loopholes in the system and trying out their limits. They need to shape the product and select the right customers carefully.

‘Ultimately, you’re facing an environment where customers are sometimes very creative and you also have to be very creative in catching fraud or managing the credit risk.’ – Michal

How are they mitigating the risk?

Traditional banks require proof of employment, proof of salary and a lot of paperwork via a personal presence most of the time credit issuing is involved.

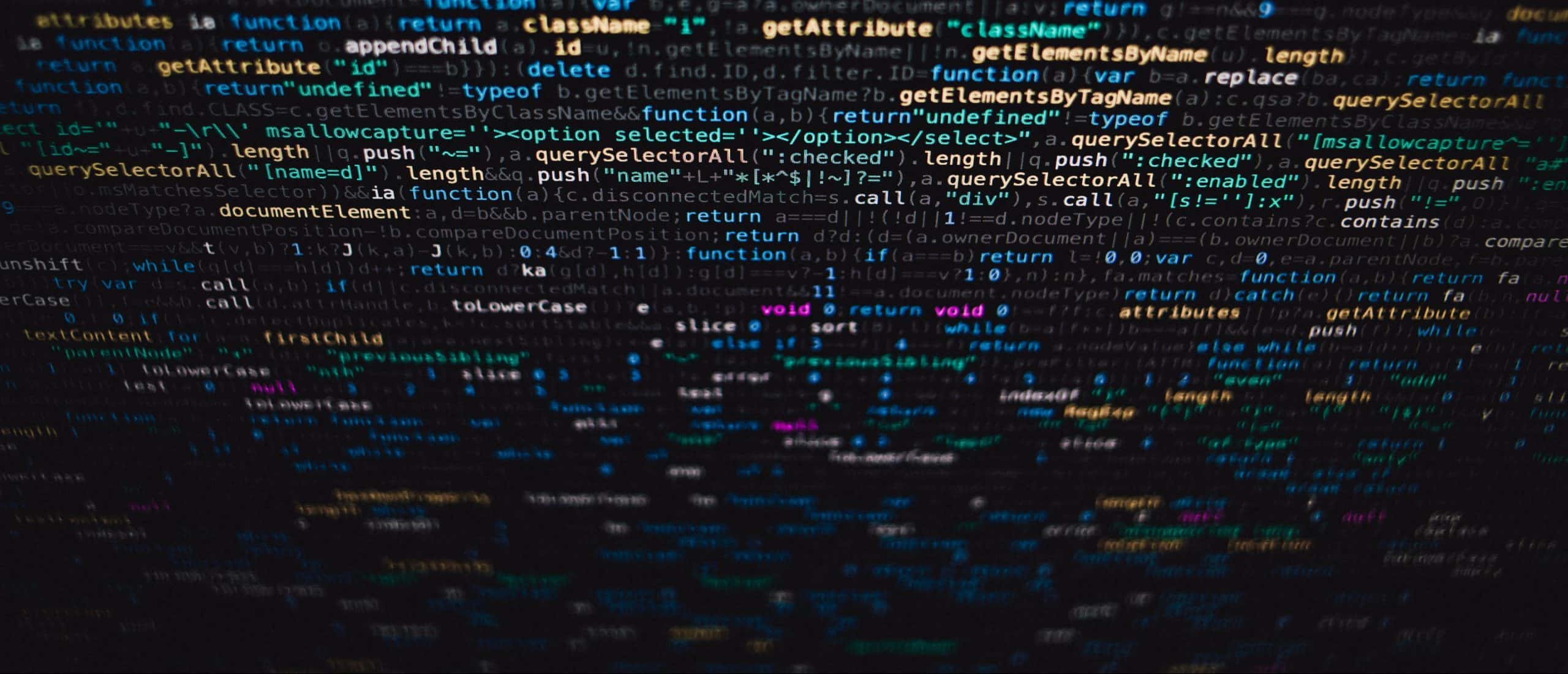

Twisto instead scores the clients based on their online footprint, using the following criteria:

- Online shopping data.

- Technical device data.

- Geolocation data from Google open API.

- Data from Credit Bureaus (being a regulated entity, they have access to all this information).

The end to end scoring process is powered by AI and delivers a credit decision in milliseconds. Fun fact, they call their risk engine Nikita based on the action-thriller TV series, called ‘Brutal Nikita’ in the region.

‘We also offer our risk engine to third parties. There are banks, lending institutions, but even e-commerce sites who want to do online deferred payments or loans; they can implement Nikita and use it as a service in addition to the credit bureau data that they already collect.’ – Michal

Twisto offers an API driven service where they become part of the checkout process of merchants. By enriching the data sources, they can give their partners a completely different data set and view on each customer.

What’s the next step?

According to Michal, the CEE region has lots of room to grow, as purchases with buy now pay later solutions are still under 5% of all payments. His prediction on the growth is that this number will be 20% to 30% of all online payments within five years.

‘For us, the next step is introducing interest-free installments and allowing customers to pay for bigger purchases over time, interest-free. And that’s ultimately where we see the industry heading. We see it’s working very well for Klarna, ZipMoney, and Afterpay, and we want to bring this model to Central and Eastern Europe as well.’ – Michal

To achieve that growth, merchants will need to consider paying a higher margin for the service in exchange for the benefits of the buy now pay later solutions.

Twisto’s collaboration with Vacuumlabs

As we all know, some Black Swan events have happened in the past six months, whether we are talking about the lockdown or the downfall of providers such as Wirecard. This period highlighted some development opportunities for fintechs.

‘What happened at Wirecard, one of the biggest processors of fintechs in Europe, going from a 24 billion valuation to zero and insolvency and losing their license for four days, resulted in one of Twisto’s products not working properly. Fortunately, we had a backup solution, so we were able to switch our clients to that in a short time. But it was a big stroke. Who would have imagined that one of the biggest fintechs would collapse in a matter of a week?’ – Michal

As Michal sees it, fintechs will ultimately need to become more robust over the years, making sure there’s a continuity in providing customer service. In his opinion, we’ll see more cross-collaborations between banks and fintechs in the next ten years, servicing clients together. He also mentioned that there will probably be more resources allocated to building the infrastructure of fintechs, namely always having a Plan B.

‘I think it’s been a bit of a wake-up call to many of the fintechs, that you cannot rely on other fintechs for stability. So I think many of the fintechs, to build trust among customers, need to show a robust technical and secure solution.’ – Michal

With this in mind, Twisto will soon tackle challenges around:

- Attracting the right customers

- Achieving self-sustainability

- Being differentiated and positioning their products well

‘The key question for us that will be on our mind for the remainder of the year and going forward is how we will position ourselves as a love brand with customers. How do we kickstart the growth and ensure that customers will still have a bank account, but using Twisto daily for their payments?’ – Michal

Key resources, related articles:

- Michal Smida’s LinkedIn profile

- Marcel Klimo’s LinkedIn profile

- Twisto website

- When payments stop flowing, let’s not throw the entire fintech industry under the bus

- Twisto Case Study

Banking on Air podcast explores the lives and journeys of founders and technology leaders as they work to overcome challenges while building products in an ever-changing world. This episode was hosted by Marcel Klimo from Vacuumlabs.

Listen to the original podcast episode on Apple Podcasts, Breaker, Google Podcasts, Overcast, Pocket Casts, Spotify, or here: