When you think about banking, “blockchain” might not be the first thing that comes to mind. It’s often associated with cryptocurrencies or NFTs, but blockchain has a much bigger role to play, especially in modernizing how financial institutions operate. From improving transparency to cutting costs, blockchain is becoming the not-so-secret weapon in banking’s future.

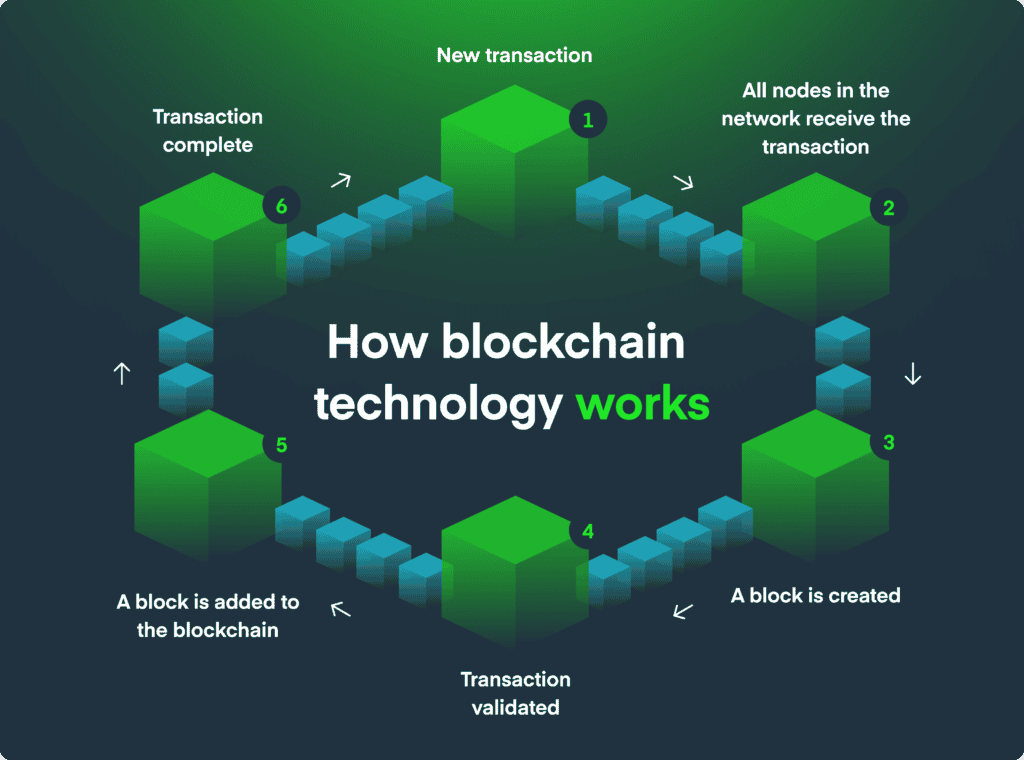

Imagine a chain of blocks (hence the name), each containing data—like transaction details—and a unique code called a hash. When a new transaction occurs, it’s verified by multiple computers (nodes) in the network before being added to the chain. Once it’s locked in, it’s practically impossible to alter without changing every block that came after it.

When talking about blockchain, a ledger is then defined as a digital and decentralized record of all transactions that happen on a blockchain network. Unlike traditional ledgers used in banking, blockchain ledgers are distributed across a network of computers (nodes). This means no single entity controls it.

Bonus fact: Each transaction is timestamped, verified, and visible to authorized participants, making the whole process secure and transparent. 🔐

Read more about blockchain and bitcoin base layer and lightning network.

If you want to go more in depth, we recommend article about side chains and wrapped coins.

Unlike traditional banking systems that rely on centralized servers, blockchain operates across a distributed network. Why does this matter? Because decentralization means no single entity controls the system—it’s managed by everyone in the network.

This also brings transparency into play. Every transaction is visible (to those with permission) and recorded permanently, which makes shady activity much harder to hide. For banks, this means clearer audits, better regulatory compliance, and more trust from customers.

Security is the cornerstone of blockchain technology. Its cryptographic nature ensures that data is protected, and its decentralized design means there’s no single point hackers can target. Transactions are verified through consensus mechanisms, like proof-of-work or proof-of-stake, adding another layer of protection.

In a world where cybersecurity threats are growing, blockchain offers a reliable shield for sensitive financial data.

Blockchain really shines when it comes to efficiency, but it can also solve numerous pain points and open new opportunities for services. We did some research into the most significant ones on our radar for the coming years:

As financial institutions face growing pressure to innovate, blockchain offers a powerful way to enhance efficiency, security, and trust. Still wondering if blockchain is worth the hype? Here are the key points to keep in mind before you decide:

Blockchain in banking isn’t just a trend – it’s a critical part of digital transformation in the twentieth century and beyond. We’ve been working with blockchain technology since its early days, gaining valuable insights through hands-on experience. Now, we’re ready to leverage its many new benefits in innovative ways.

Today, we’ve seen how crypto and blockchain technologies are transforming financial services by enhancing security, transparency, and efficiency. From on-chain payment cards to crypto-denominated accounts, we know how to bring these innovations to bridge the gap between traditional finance and the crypto world, unlocking new business opportunities.

Adopting these trends now will help you stay ahead in fintech innovation. Explore these opportunities and let’s collaborate together to bring cutting-edge solutions to your organization.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

Retail Banking

B2B Banking

Fintech and Neobanks

Product

Engineering

Operations

Latest Whitepapers

Interested in a specific topic?

Let us know - we are happy to help

Thank you for contacting us! One of our experts will get in touch with you to learn about your business needs.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You can also "Reject All".

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |