In a world where every swipe, tap, and click connects us to an ever-expanding digital universe, one thing is clear: the future of banking isn’t just about numbers and transactions, it’s about experiences and aspirations. In this environment, banks find themselves at a crossroads, facing a critical question: Are they ready to embrace the digital age, or will they be left in the rearview mirror of financial innovation? The answer lies in a realm where the traditional meets the daring of fintech: digital-first wealth management apps.

But why would banks do something fintechs have already capitalized on? We asked Bitpanda Technoogy Solution for their opinion and Anton Langbroek, Vice President Commercial B2B kindly gave us the answer:

That’s just the start. Join Vacuumlabs as we delve into the world of wealth management innovation, where we’ll explore why everyone should join this financial revolution.

Customers Need Something New

An innovative digital investment platform empowers individuals, equipping them with the tools to make well-informed investment decisions, effectively bridging the gap between traditional mutual fund models and the dynamic needs of today’s investors. This forward-thinking solution caters directly to the digitally native demographic, a market segment that is instrumental for sustainable growth and relevance.

Bring New, Valuable Customers Through the Door

A report by McKinsey highlights that digital investment platforms enable banks to offer personalized, algorithm-driven advice, catering to the individual risk profiles and investment goals of clients, thereby increasing customer satisfaction and loyalty.

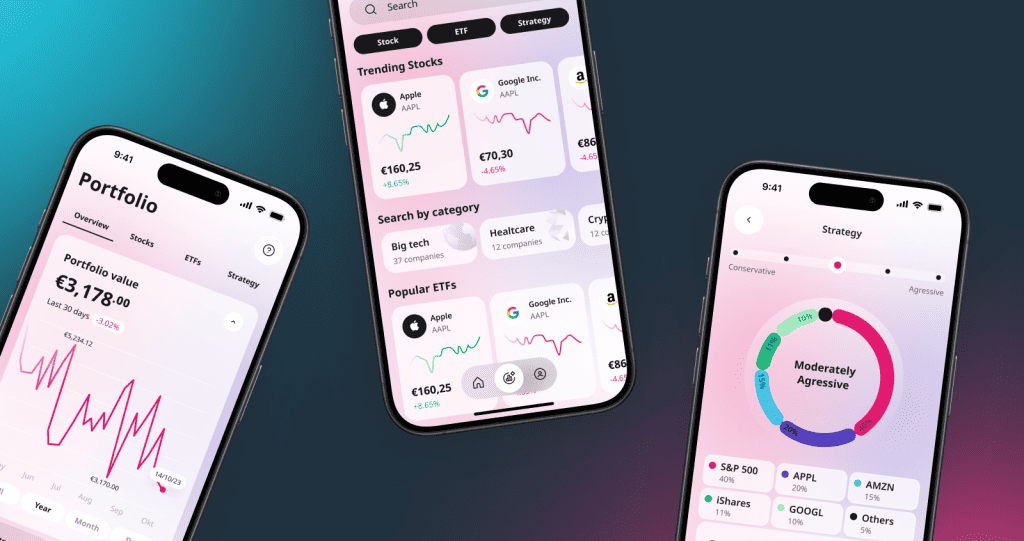

Banks introducing fully digital investing platforms can also attract a new demographic of clients who are looking for diversified investment opportunities beyond traditional mutual funds. These platforms can offer a wider range of investment options like exchange-traded funds (ETFs), which typically have lower expense ratios compared to mutual funds. This shift not only provides customers with more cost-effective investment choices but also enhances flexibility, allowing for real-time portfolio adjustments and customization.

Entice Customers With More Choice and Control

By offering a platform that puts investment decisions directly in the hands of customers, the bank empowers them to take charge of their financial future. This aligns with the growing trend of investors seeking more personalized and hands-on approaches to their portfolios.

There is a growing interest in investment among the general populace. The Global Investor Study conducted by Schroders in 2020 found that more people are looking to invest their savings to achieve higher returns compared to traditional savings methods. This trend is partly driven by the low-interest rates offered by banks on savings accounts, pushing individuals to seek alternative ways to grow their wealth. By offering digital investing platforms, banks can provide these potential investors with an easy entry point into the world of investing, democratizing access to financial markets and catering to this increasing appetite for investment opportunities.

Boost Engagement with Financial Literacy

A digital app with a user-friendly interface, coupled with its educational resources, presents an opportunity to contribute to increasing financial literacy among customers. As they become more informed investors, they are likely to engage more actively with the bank’s wealth management services and even existing services.

Banks Are Uniquely Positioned

For this one, we collected expert insights from the team at Multiply:

“[Banks can] leverage existing data and brand and relationships to increase cross-selling opportunities. They tend to have the highest numbers of DAUs (daily active users) and that attention and the resulting trust from customers is extremely valuable. They can observe the market and see what has worked and what hasn’t from more innovative fintechs.”

Vivek Madlani, Co-Founder & CEO – Multiply

Mike Curtis, Co-Founder & Chief Technology Officer – Multiply, expands on this idea:

Banks have huge existing customer bases, and I think there is a huge advantage to being the place where a person’s salary gets paid into and banks can cross-sell. I think the biggest risk to banks from fintechs is actually other banks copying fintech features and in doing so acquiring customers from their competitors. I also think there are long-term demographic risks to the customer base – more young people will adopt solutions that are digitally up to scratch – good quality digital experiences are more important than bricks and mortar for a younger generation – this is likely to be a slow trend but ultimately if banks can’t adapt they risk being left behind.

Attract the Rising Tech-Savvy Demographic

In an era where digital experiences dominate, investment apps cater to the preferences of the digitally native generation. It provides them with an intuitive, technology-driven platform to manage their investments. This not only attracts a new demographic but also strengthens customer retention.

Generational interest in investing, particularly among Gen Z and Millennials in the EU, shows notable differences from previous generations. The Internet has greatly democratized investing, making it more accessible to younger generations with even less disposable income. Millennials, with increasing disposable income as they progress in their careers, are showing distinct investment habits, often choosing to invest in cryptocurrencies, tech stocks, and green energy, reflecting their awareness of social and environmental consequences. Only 20% of Millennials would work exclusively with an advisor, preferring autonomy in their investment decisions. They also tend to favor digital, automated algorithms (robo-advisors) over human contact for investment advice.

Gen Z in particular is more money-conscious than previous generations, with studies showing up to 10% already saving or planning to save for retirement. They are also inclined to use online forums and discussion boards for investment learning, utilize gamified investment platforms for risk-free trading experience, and engage in micro-investing applications.

Expanding Revenue Streams

The introduction of a digital investment app presents opportunities for additional revenue through transaction fees, premium features, AUM fees, and other sophisticated fee structures. It diversifies revenue streams and positions the bank as a forward-thinking financial institution.

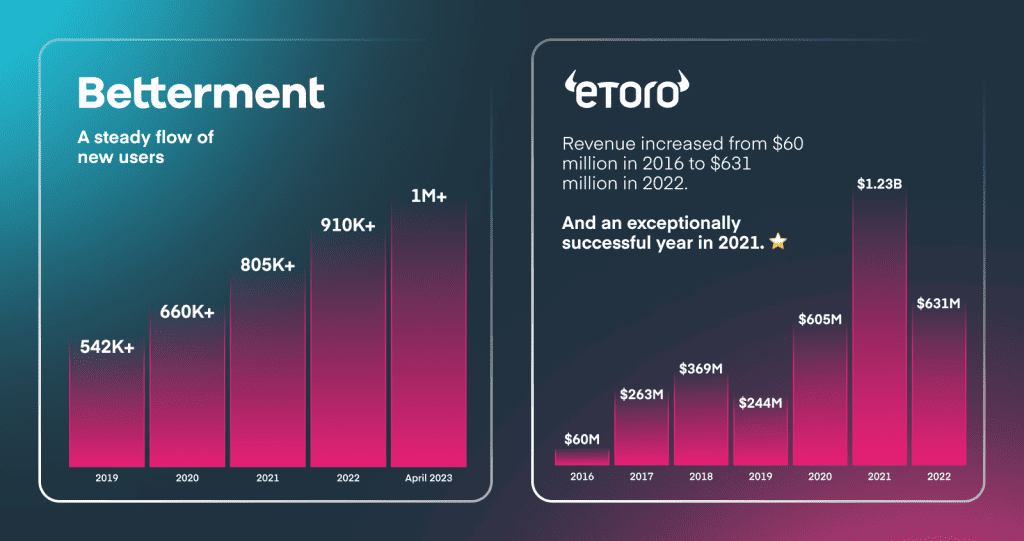

If you want proof, we can look at popular fintechs that have brought in new users and a steady stream of revenue since their inception:

So, what do banks stand to gain?

The answer is as compelling as it is undeniable: these apps are the key to unlocking a world of possibilities for both financial institutions and their clientele, redefining how we manage, grow, and protect our wealth.

If you are curious to learn more, read the full guide on wealthtech here.