Imagine a busy marketplace before we even had computers – here a merchant records every transaction manually in a book to make sure nothing is overlooked in the day’s confusion. His survival and livelihood depended on this early type of ledger. Even though ledgers have changed over time, their fundamental purpose of maintaining an exhaustive record of financial transactions has not changed.

The foundation of accounting systems are ledgers. They ensure financial stability and accountability by assisting businesses in tracking their revenue and expenses. Blockchain technology gives this idea a contemporary twist by decentralizing the conventional ledger, which makes it not only a tool for recording but also for guaranteeing.

What is a ledger – the basic definition of a ledger

Let’s summarize that first into the most basic definition: Whether it’s called a general ledger, accounting ledger, or financial ledger, it’s where all the money moves are recorded.

From every dime spent to every dollar earned. It’s the single source of truth that links all financial activities together.

What are ledgers used for

Ledgers assist traditional banks in monitoring everything from intricate loan agreements and investments to daily deposits and withdrawals. Every transaction tells a tale about the origins and destinations of money.

Neobanks, the traditional banks’ digital-first cousins, rely mostly on digital ledger technology. For them, ledgers need to be quick, secure, accurate, and integrated with other financial technologies. Neobanks can now provide real-time transaction tracking, instant balance updates, and smooth payment processing thanks to this integration, which improves customer satisfaction and operational effectiveness.

The ledger idea is expanded upon in the field of blockchain technology. Distributed ledger technology, which is used by blockchains, records transactions using an unchangeable cryptographic signature known as a hash. This secures transactions in addition to recording them. Because each block in a blockchain ledger is connected to the one before it, it is very challenging to change historical records covertly. This feature is especially helpful in sectors like supply chain management and cryptocurrency transactions where security and transparency are crucial.

How was the ledger developed? – The brief history of a ledger

When delving into the history of ledgers, we see their origins stretch back to ancient merchants using clay tablets for record-keeping. The core idea and technology, while simple, evolved significantly over time. Moving forward to Renaissance Italy, we find a key development in how ledger technology is understood today. A brilliant mathematician named Luca Pacioli popularized a method that was starting to take a foot hold: double-entry bookkeeping. His work refining and spreading this concept laid the foundational principles of modern accounting, including the ledger system as we know it today.

The development of the ledger over centuries paralleled advances in commerce and technology, growing in complexity to meet the needs of expanding trade networks and more sophisticated economic structures. Today, blockchain technology stands as the next monumental leap in this evolution. Blockchain acts as a distributed ledger that extends the traditional functionality to a global scale where transactions are not only recorded but also verified across multiple nodes, ensuring accuracy and immutability.

If you’re interested in a deep dive into this history and how it shapes our understanding of blockchain today, read all of the fascinating details here.

What is recorded in the general ledger?

When we talk about a general ledger, it contains a complete record of all the financial transactions of a company. This includes detailed accounts of sales, purchases, payroll, and other financial transactions.

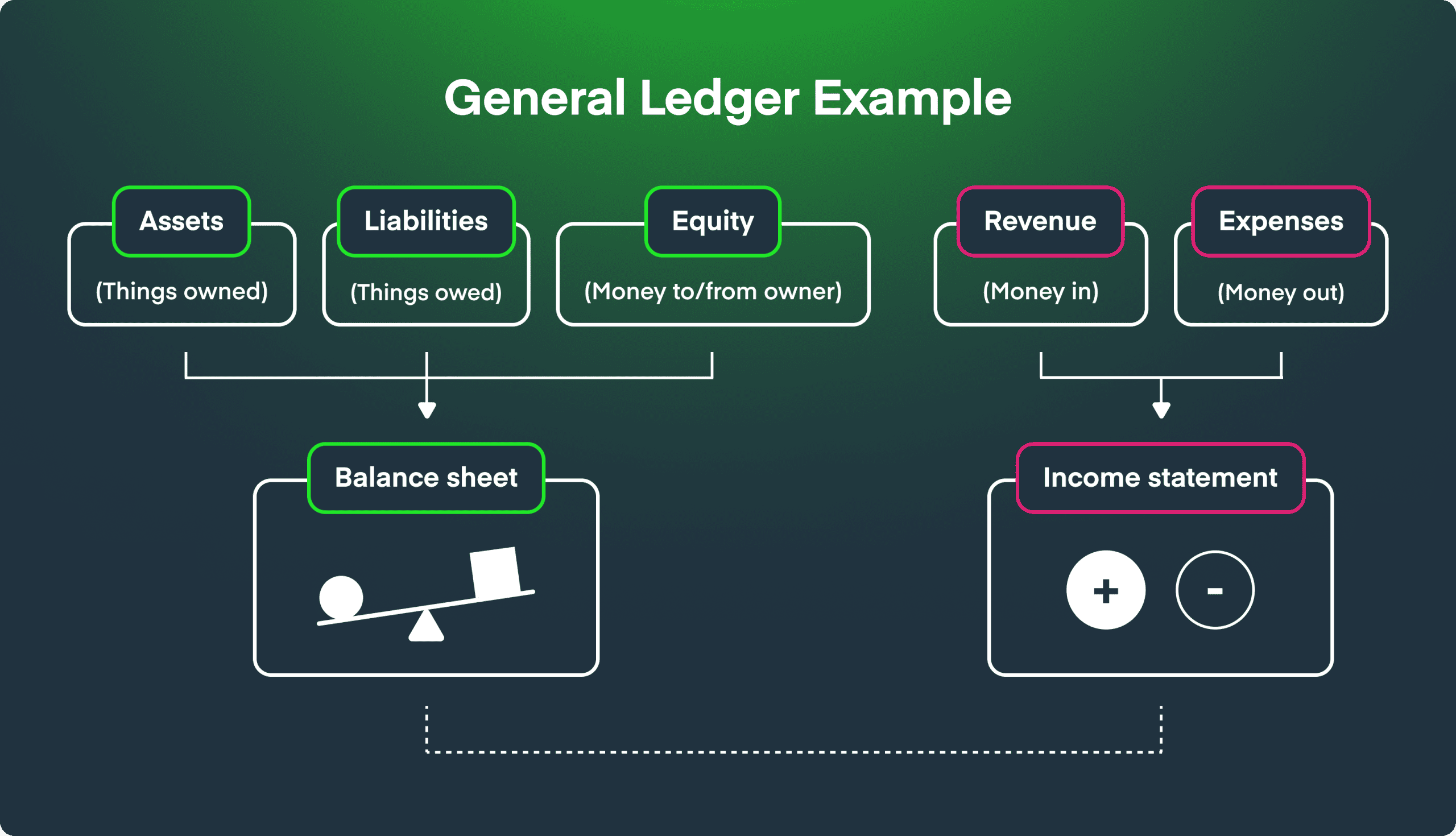

The general ledger holds accounts for assets, liabilities, equity, revenues, and expenses and each transaction enriches the ledger’s story, helping stakeholders understand the financial narrative of the business.

As blockchain technology permeates the financial world, it enhances the capabilities of the general ledger by providing an incorruptible and efficient platform to maintain these records, where each entry is verified and sealed against fraud or tampering.

Here is a recap:

- Assets: The value of property which is owned by the company, or part-owned, e.g., shares.

- Liabilities: The amount of what the company owes, eg, bank loans.

- Equity: Capital contributed into the business and withdrawals by owner(s).

- Revenue: Money coming into the business as sales, interest or dividends.

- Expenses: Money spent to keep the business going, eg, rent.

Example of a general ledger

Let’s take a look at a more concrete example of a ledger. Imagine you’re a coffee shop owner. Each purchase of a latte, each bag of beans sold, and every payment to suppliers is recorded in your general ledger. This ledger is your financial diary, cataloging the pulse of your business activity day by day. Rather than just list what it entails, take a look below at a simple example:

In a blockchain-enabled world, this coffee shop’s ledger is not just some book on a shelf but a live, safe, and distributed ledger. As an example, when a consumer buys a cup of coffee, the transaction gets recorded in a block, tagged with the time and date, and linked to the previous transaction, forming a chain that anyone can see and verify. This not only assures the integrity of the records but also creates a sense of trust with customers as well as suppliers, showing the real-world usage of blockchain for everyday business processes.

How does the general ledger do a report?

Within accounting, the general ledger accumulates financial data from several accounts and presents it in elaborate summaries. These summaries, including balance sheets and income statements, show the financial condition of a company.

The integration of blockchain into this process can revolutionize how reports are generated, offering real-time data compilation with enhanced accuracy and security. This technology ensures that once a transaction is recorded in the ledger, it cannot be altered, making financial reports more reliable and trustworthy.

What types of ledgers are there?

In finance, ledgers are significant instruments employed in the control and documentation of various types of financial transactions.

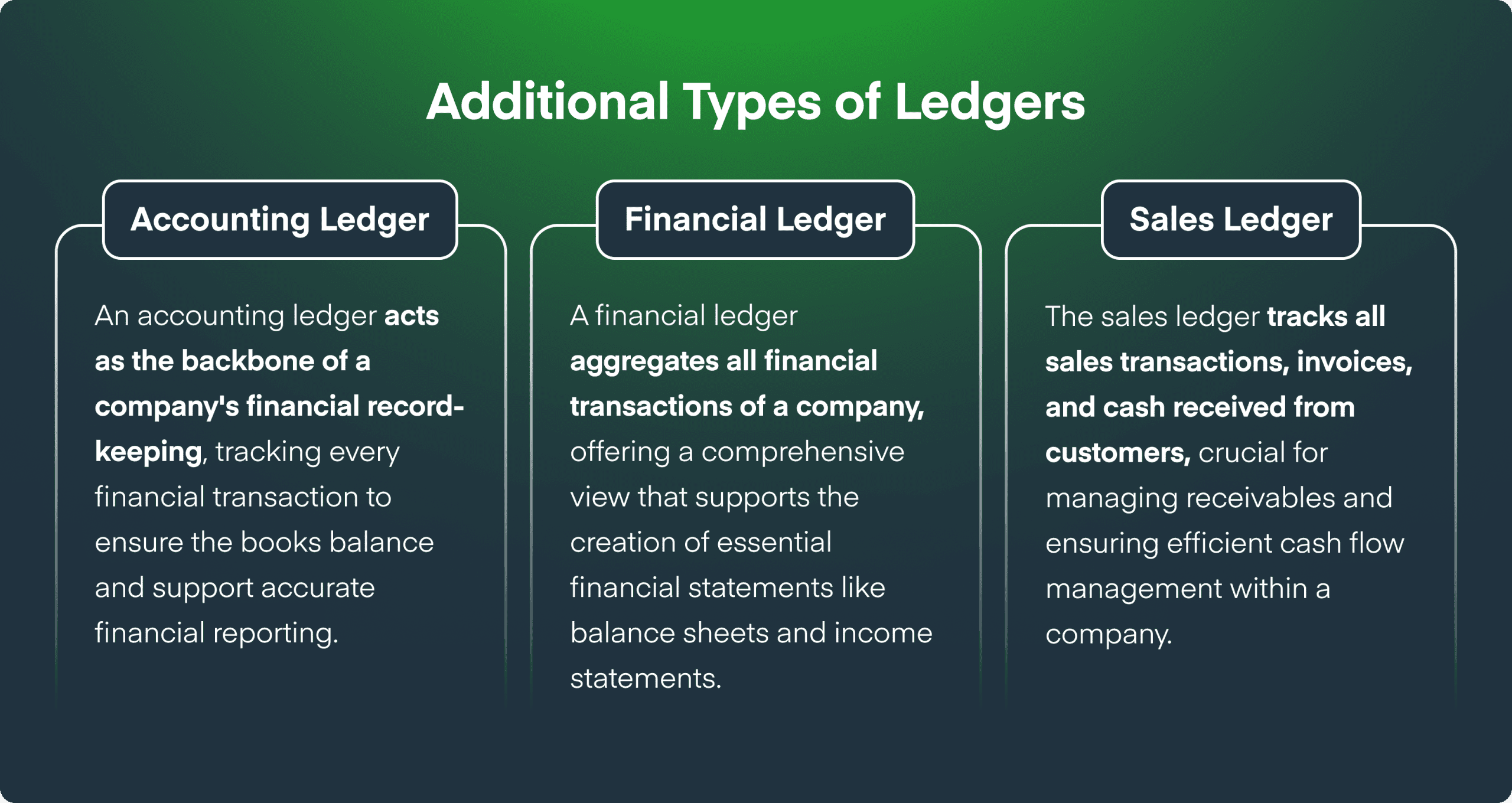

Accounting Ledger

An accounting ledger, occasionally envisioned as the spine of a company’s financial record-keeping system, monitors all of a company’s financial transactions in detail. Each transaction is documented in a way that maintains the balance of the company’s books, by recording debits and credits in different accounts. The ledger serves as the hub for maintaining all financial activities in balance, from operational expenses to revenues, helping ensure accuracy and consistency in financial reporting.

Financial Ledger

Financial ledger is a broader term that often encompasses a number of subsets of ledgers, including the general ledger and others that record more specialized financial information. The financial ledger provides a summary of all the financial transactions that affect the company’s financial position. It summarizes information from various sub-ledgers, providing a snapshot of financial condition and facilitating the preparation of financial statements like the balance sheet and income statement.

Sales Ledger

Also known as the accounts receivable ledger, the sales ledger is focused on recording all sales made by a company, amounts invoiced to customers, and cash received. It’s vital for tracking money owed by customers (receivables) and chasing payments to ensure timely receipt. The ledger enables companies to keep customer accounts organized, with a record of all sales and receivables that need to be clear for effective financial planning and analysis.

These ledgers, each with its specific focus and purpose, collectively ensure a company’s financial operations are executed efficiently and its financial reporting is accurate and dependable. They are components of financial management, providing necessary visibility to a company’s financial operations and position.

What is a ledger in traditional banking terms

In a traditional bank that does not use blockchain technology, a ledger works as the core record-keeping system. It’s basically a detailed log where all financial transactions are recorded. The ledger in a traditional bank is central to its accounting system and helps the bank keep track of everything from daily transactions to the bank’s overall financial status.

For example, if you deposit $500 into your account, the bank’s ledger records this transaction by adding $500 to your account balance. Similarly, if you then pay a $100 utility bill using your bank account, the ledger records a $100 deduction from your account. The ledger ensures that every transaction is accounted for, making it possible for the bank to provide you with accurate balance updates and statements.

What is ledger technology when we talk about blockchain

Blockchain technology is shaking up traditional banking ledgers by introducing a decentralized framework that boosts security, transparency, and efficiency. Unlike typical ledgers that are managed by a centralized entity such as a bank, blockchain disperses its data across an entire network. This decentralization ensures that no single point can alter the data unilaterally, preventing data manipulation and increasing transparency. Public blockchains allow open access to information, whereas private blockchains restrict access to selected users.

What is blockchain technology

If you’re looking for a straightforward explanation of blockchain technology, we can cover that: Blockchain is a type of distributed ledger technology that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively. This technology is characterized by its features of decentralization, transparency, and immutability.

Primarily known for its role in enabling cryptocurrencies like Bitcoin, blockchain’s applications extend beyond financial sectors to include uses like secure data sharing and supply chain management. For instance, in blockchain-based systems, every transaction is recorded in a block, verified by multiple nodes across the network, and then linked to the preceding transactions. This creates a transparent and secure transaction history.

Blockchain’s immutability means that once data is entered, it cannot be altered, thus securing it against unauthorized changes and threats. This permanent, uneditable nature contrasts sharply with traditional systems, which are vulnerable to human error and data manipulation. Moreover, blockchain eliminates intermediaries in transactions, which reduces potential corruption and speeds up the transaction process.

Integrating AI with blockchain can further enhance capabilities by automating complex decisions based on changing market conditions or other variables, thus making financial systems more adaptive and robust. Transitioning from traditional to blockchain ledger technologies represents a significant advancement towards creating more secure and efficient financial systems.

What we can do going forward

The future developments in ledger technology are promising and multifaceted, particularly with the integration of blockchain and AI. AI can help transform ledger technologies by automating complex processes that involve large volumes of data, leading to more accurate forecasts and financial insights. This can improve decision-making processes and increase efficiency in operations.

If you’re intrigued by the potential of future ledgers, we have you covered: we can help you with both blockchain adoption and AI transformation. With experience in both since their early days, we can help you cut through the future hype and get practical, applied uses out of these technologies today.