A few years ago, most of us were asking, “What is an electronic wallet?” and “Do I really need one?” Now, digital wallets are something we rely on daily.

But what really is a digital wallet?

In a simple description, a digital wallet, also called an e-wallet, electronic wallet, or mobile wallet is an app that runs on mobile devices like smartphones and tablets. It stores your payment information securely and allows you to pay directly from your device, whether you are at a shop, an online checkout, or even sending money to a friend.

Simple. Fast. Always in your pocket.

How digital wallets work

The way digital wallets process payments depends on the technology they use.

- Near-field communication (NFC)

This allows two devices to communicate when they are just a few centimeters apart. When you tap your phone or smartwatch at a payment terminal, your digital wallet sends encrypted payment information instantly via NFC. It is fast, secure, and supported globally by most modern terminals. Apple Wallet, Samsung Wallet, and Google Wallet all rely heavily on NFC for in-store transactions.

- Magnetic secure transmission (MST)

Less common but still important, MST mimics the magnetic strip of a traditional credit card. It works by sending a magnetic signal from your phone to the payment terminal. Some Samsung Wallet devices still support MST, making it compatible with older terminals that don’t accept NFC.

- Quick response code (QR)

QR codes are a dominant method for mobile payments in Latin America and Asia. You scan a code (or have yours scanned) and confirm the transaction in your wallet app. It is particularly popular for peer-to-peer payments, small vendors, and even street food stalls. Digital wallets like Alipay, Paytm, and even Apple Wallet (in certain contexts) use QR codes to simplify the checkout experience.

Where can you use a digital wallet?

Digital wallets are so ubiquitous now, you’ve probably already used them every possible way without evening thinking about. One day, you pay for coffee through an app. Another day, you buy something online without reaching for your card. That’s all your digital wallet at work.

You can use your digital wallet to:

- In stores, where you hold your phone near the terminal to pay.

- Online, when checking out on certain websites, you can choose your digital wallet instead of manually typing in your card info every time.

- In apps, where apps let you pay straight from your wallet with a tap or swipe.

- At ATMs, when you use your card in the wallet app and tap your phone at a contactless-enabled ATM to withdraw cash or make a deposit.

Is payment stored on the phone?

Not really. Your actual card number is not saved on the device. The virtual card number is assigned only to the digital wallet and mobile device you use. Every payment needs your face, fingerprint, or passcode. So even if you lose your phone, your money stays safe.

Types of digital wallets

What is the best digital wallet for you? What types of digital wallets are there?

There is not just one kind of digital wallet, and the differences usually come down to the platform or brand you are using.

If you have ever asked what an Apple Wallet or what a Samsung Wallet is in practical terms, here is a short description:

- Apple Wallet is built into iPhones and Apple Watches. It lets users make contactless payments, store tickets, boarding passes, and even ID cards. It works with Face ID or Touch ID for quick and secure checkout.

- Samsung Wallet combines Samsung Pay and Samsung Pass. Along with payments, it can also hold loyalty cards, digital keys, and crypto wallets. It works on supported Samsung devices and supports both NFC and MST.

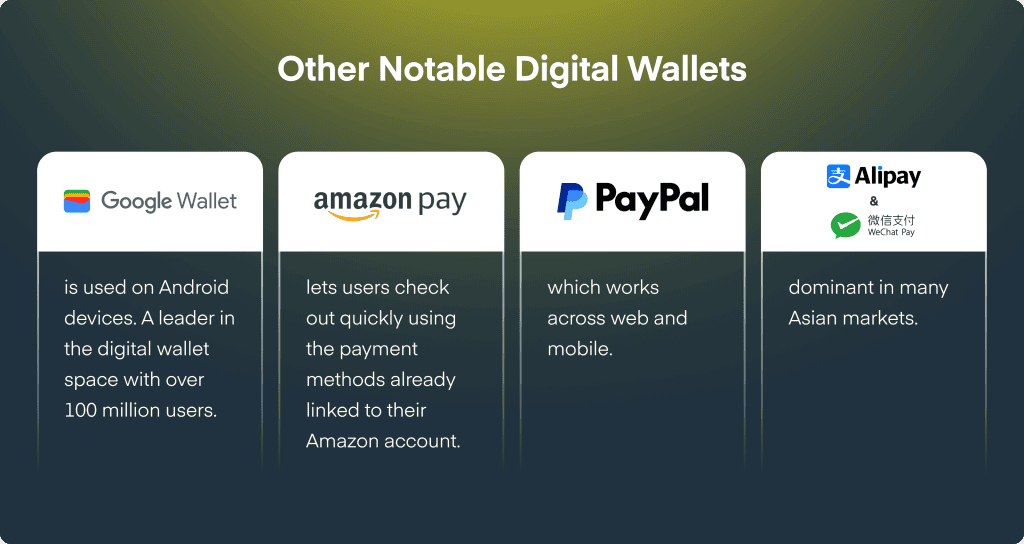

Other major wallets include:

- Google Wallet is used on Android devices. A leader in the digital wallet space with over 100 million users.

- Amazon Pay lets users check out quickly using the payment methods already linked to their Amazon account.

- PayPal, which works across web and mobile.

- Alipay and WeChat Pay, dominant in many Asian markets.

What else can digital wallets do?

Beyond storing your credit or debit cards, digital wallets can also keep things like gift cards, loyalty cards, and even your boarding pass all in one place. In the future, we might see more digital wallets holding digital IDs, driver’s licenses, cryptocurrency, and even digital car keys.

- Gift cards

- Membership cards

- Loyalty cards

- Coupons

- Event tickets

- Plane and transit tickets

- Hotel reservations

- Driver’s license ( only in some states as of now, AZ, CO, GA, MD)

- Identification cards

- Cryptocurrency

- Car keys

How to accept digital wallet payments

Accepting digital wallet payments is simpler than it used to be, and most modern payment systems already support it.

In-store:

To accept wallets like Apple Pay, Samsung Pay, or Google Pay, you will need a card reader or terminal with NFC. Most newer payment terminals come with this built in, allowing customers to simply tap their phone or watch to pay.

Online:

If your website already accepts online payments, enabling digital wallets usually takes just a small integration update. Many payment systems now support digital wallets by default at checkout, and some even allow customers to scan a QR code to complete the purchase on their phone.

In mobile apps:

Wallets can be used within mobile apps as well. At checkout, users simply authenticate using their face, fingerprint, or passcode.

Benefits of digital wallet payments for businesses

Digital wallets aren’t just convenient for customers, they offer real advantages for businesses, too.

1. Better customer experience

Customers do not need to enter card details or carry physical wallets. Digital wallets create a smoother, faster checkout process, both online and in person.

2. Built-in security and fraud prevention

Unlike traditional card payments, digital wallets use tokenization, encryption, and biometric verification (like face or fingerprint ID). This means sensitive card data is not shared with merchants, reducing fraud risks, chargebacks, and compliance burdens for businesses.

3. Real-time data and customer insights

Digital wallet systems give businesses access to instant transaction data, including spending patterns, popular products, and peak hours. This insight can fuel personalized offers, loyalty programs, and better inventory or marketing decisions.

4. Lower operational costs

With fewer manual processes (no physical cards, reduced cash handling, less paperwork), digital wallets help streamline operations and reduce payment errors and processing delays. They also eliminate the need to print and store physical receipts in many cases.

5. Preparedness for a cashless future

Consumer behavior is changing fast. According to Worldpay, over $28 trillion will be spent via digital wallets globally by 2030, with wallets expected to make up 52% of all e-commerce payments. Companies that do not support this payment method risk losing out on a growing segment of customers who now expect fast, digital-first checkout experiences.

6. Flexibility across channels

Whether you sell in-store, online, or via a mobile app, digital wallets support all environments. That cross-channel flexibility is key for omnichannel businesses aiming to offer a consistent and modern customer journey.

Are digital wallets safe?

Digital wallets are actually much more secure than most people think. With built-in features like encryption, tokenisation and biometric authentication (like Touch or Face ID), they create multiple layers of protection. Unlike a physical wallet, no one can just grab your phone and access your funds.

This layered security model significantly reduces the risk of card-present fraud and data interception. When implemented with a secure infrastructure and strong authentication flows, digital wallets can offer a higher level of protection than many traditional payment systems – mobile wallet security is a good example of this in action.

How can Vacuumlabs help?

Building a secure and user-friendly digital wallet requires a deep understanding of compliance, fraud prevention, and the user experience. Vacuumlabs specializes in secure, scalable fintech development that doesn’t trade off innovation.

Whether you are a bank aiming to modernize your services or a startup launching a new payment platform, our team can assist in creating a digital wallet that meets your needs.

Explore our services in feature development, fraud detection, and fintech engineering to learn more.