The financial world is rapidly evolving, driven by changing consumer needs and technological advancements. The Buy Now, Pay Later (BNPL) sector is experiencing a remarkable rise in Europe and is forecasted to reach an impressive €300 billion by 2025. When the term BNPL is mentioned, names like Klarna and Affirm likely come to mind. These companies specialize in providing BNPL financing options for purchases at participating retailers. However, is this path easy for all? Some BNPL providers are currently facing significant challenges.

For banks, this transition point represents a unique opportunity to redefine their credit offerings and assert their relevance and competitiveness in the market.

In this article, we delve into the dynamic financial terrain, highlighting the surge of Buy Now, Pay Later (BNPL) services and elucidating the distinctive advantages that a BNPL app tailored for banks can bring. We explore the integration of BNPL features, offering banks a competitive edge, and bolstering consumer trust. The article outlines strategic steps for banks, underscores the role of digital innovation, and envisions the symbiotic future of BNPL and credit cards.

Understanding the BNPL Phenomenon

The rise in e-commerce transactions during the COVID-19 lockdowns led to a significant increase in the use of Buy Now, Pay Later (BNPL) services, which contributed to the growing demand.

The competition among Buy Now, Pay Later (BNPL) apps is reshaping the landscape of the European mobile BNPL market. In recent quarters, traditional BNPL apps – such as Klarna, Clearpay, and Affirm – have achieved together nearly 10 million installs in the first half of 2022. These services have become popular mainly with Millennials and Gen Z because they provide a fast and frequently interest-free method to pay for purchases over a period of time.

However, concerns have arisen about the potential financial risks associated with pure-play BNPL companies. Unlike traditional banks and credit card institutions, BNPL providers are not required to conduct “ability to pay” evaluations or provide consumers with truth-in-lending statements. This lack of scrutiny raises the possibility of increased debt accumulation and financial distress for certain users.

Here is where the opportunity comes for banks

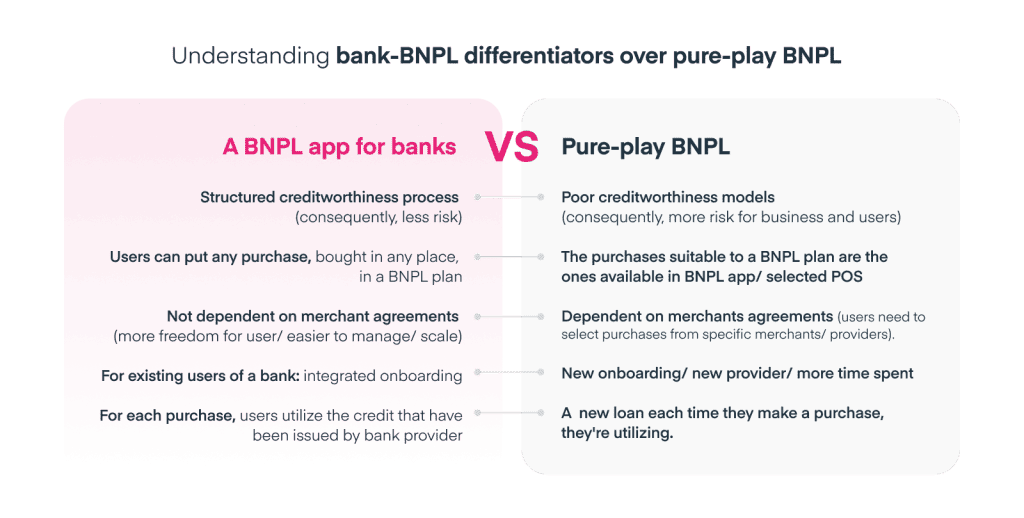

However, pure-play BNPL providers face challenges due to inadequate creditworthiness assessments, leading to financial struggles and unprofitability. This vulnerability in the BNPL model highlights a significant opportunity for banks.

- Banks are prepared to handle financial risks.

With established processes for assessing creditworthiness, banks are well-equipped to manage financial risks. They know precisely to whom they can lend money, a capability where typical BNPL providers may struggle. By adopting a more consumer-centric approach, banks can maintain their position in the credit market and address the potential risks associated with BNPL services.

- Banks are under regulatory and legal requirements, ensure transparent consumer reports

Banks, bound by regulatory and legal mandates adhere to robust reporting requirements, ensuring transparency and user safety. In contrast, many non-bank Buy Now, Pay Later (BNPL) companies have provided incomplete or, in some cases, no information to nationwide consumer reporting agencies. It is crucial for BNPL providers to report positive data to promote consumer financial wellness.

- Banks are the user’s preferred BNPL provider

Trust plays a vital role in making financial decisions, and financial institutions have gained considerable trust from their current customers. A survey by The Financial Brand found that 78% of respondents say they would be more likely to use buy now, pay later financing options offered by banks with which they already have an account.

Banks provide more flexibility than BNPL services, which often restrict users to select merchant agreements. The combination of this adaptability and the trust people have in banks puts them in a leading position in the BNPL market.

Banks can build BNPL products/ features, taking advantage of their reputation, existing user relations, and functionalities (eg. credit assessment, payment in physical stores, an overview of accounts, etc).

A ready-to-go idea: BNPL solution for banks

Analyzing the current market, product opportunities, and user needs in the current landscape, we developed a “ready-to-go” idea that can assist banks in shaping their BNPL offerings – A BNLP app for banks, with no merchant dependency.

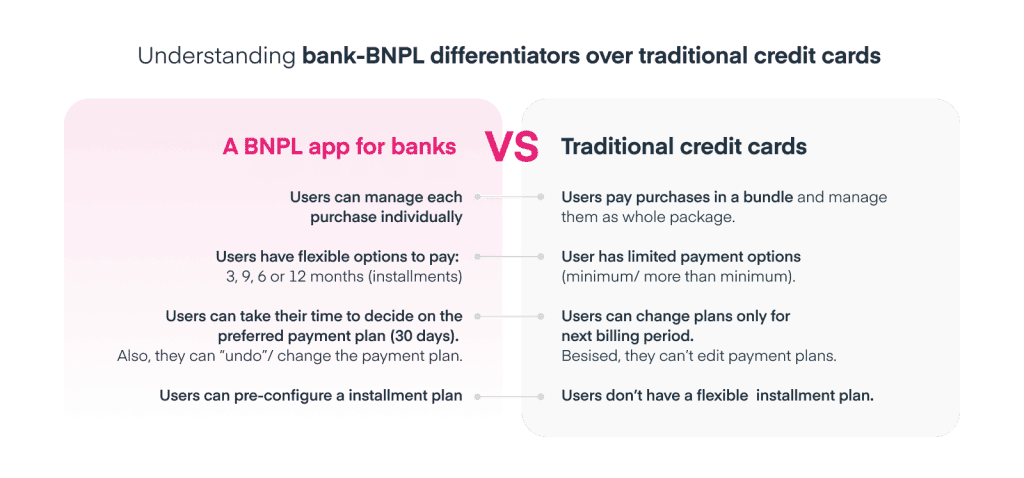

The BNPL app empowers users to make credit purchases in online and offline stores and manage their repayments directly through the app. Customers can choose the specific amount of their installment for each purchase, which is a departure from most credit cards that only allow management of purchases in a bundle.

In addition, we aim for a clear and transparent service that is free from hidden fees, confusing interest rates, and lack of visibility into payment details.

This is the product option that your bank can use to its advantage. It’s a level of flexibility your customers won’t find in traditional credit cards.

How could a BNPL app for banks work?

From flexibility to education to a shopping simulator, the BNPL app brings many benefits to users. Discover the benefits and features of the BNPL app and how it empowers your customers to navigate their financial landscape with clarity and confidence, setting a new standard for banking services.

- Flexible Installments: Users can experience the freedom to split payments over 3, 6, 9, or 12 months, with the added convenience of pre-configurable installment plans, catering to your unique preferences.

- Personalized Credit Line: Crafting a tailored credit line aligned with your users’ profiles and preferences, ensuring a bespoke financial solution that suits their needs.

- Clear Terms and Rules: Users see straight away into their financial landscape. They can track their balance, monitor spending, stay informed about upcoming payments, and keep an eye on remaining installments — all presented with crystal-clear transparency.

- Payment Management by Purchase: Break free from bundled transactions. Users can manage each purchase individually, providing flexibility and distinct conditions for every transaction.

- Purchase Simulator: Before committing to a real purchase, users can see its impact on their existing payment plan through an intuitive simulator, offering a preview of potential outcomes.

- Responsible Lending: Navigate users’ financial journey responsibly with a clear indication of interest-free periods and offer the freedom to settle debts at their convenience.

- Visual Payment Plan: Navigate the user’s financial landscape effortlessly with a visually intuitive payment plan. Each installment is detailed, ensuring a comprehensive understanding and empowering users with effective financial planning.

Choose distinction, choose a new era in banking with our BNPL ideas.

The rise of BNPL services marks a new chapter in consumer finance, one that banks can lead by innovating their credit card offerings. By integrating BNPL functionalities, and building new BNPL products, banks can offer products that resonate with modern consumers’ desire for flexibility, transparency, and convenience. The advantages gained from offering BNPL services position banks to meet today’s market needs and establish new standards in the evolving landscape of consumer finance.

At Vacuumlabs, we build products with leaders who want to innovate – building on a foundation of solid engineering, timeless design, and a deep understanding of fintech.

Collaborate with us to enhance customer satisfaction, foster loyalty, and meet the evolving demands of modern banking.

Want to read the full guide? Leave us your email and you’ll be the first one to get your hands on it once it’s ready.