What can a forward-thinking bank do to stay ahead, keep their customers, and win new ones? Vacuumlabs has been active in the fintech industry for 12 years – the major opportunity we are seeing today is the growing demand for digital-first wealth management solutions.

What is digital wealth management?

Digital wealth management refers to the use of digital technologies, such as apps, to provide comprehensive financial planning and investment management services. These tools enhance the client experience by delivering personalized financial advice, managing portfolios, and tracking investments across multiple devices and platforms.

5 Benefits of digital wealth management

- What are the benefits of digital wealth management? Why invest in building it? Here are just a few of the benefits we found in our research:

- 1. Stronger client engagement and retention

Digital tools allow you to meet clients where they are: online. Personalized dashboards, goal-based investment planning, real-time portfolio tracking, and instant communication channels make wealth management more interactive and relevant. This engagement builds trust and loyalty, significantly increasing the chances that clients stay with your institution over the long term. - 2. Efficiency through automation and self-service

By automating routine tasks like onboarding, portfolio rebalancing, and risk profiling you can reduce operational overhead while giving clients more control over their financial journey. Self-service options empower users to make informed decisions quickly, without waiting on an advisor. This blend of autonomy and support frees up advisors to focus on complex, high-value interactions. - 3. Access to rich, actionable data

Digital platforms open up access to real-time behavioral and transactional data that can be analyzed to uncover new opportunities, detect risk patterns, and tailor investment strategies. Leveraging AI and machine learning, wealth managers can offer insights previously only available to top-tier clients, democratizing quality advice and driving better outcomes across the board. - 4. Improved financial performance for clients

With advanced analytics, timely recommendations, and personalized asset allocation strategies, digital wealth management platforms help clients make smarter investment choices. This can lead to stronger portfolio performance and higher satisfaction, reflecting positively on your institution’s reputation and client relationships. - 5. Cost-effective and scalable by design

Digital wealth solutions reduce the cost-to-serve by streamlining infrastructure, minimizing human error, and allowing advisors to serve more clients efficiently. Whether you’re targeting mass affluent individuals or high-net-worth clients, a digital-first approach offers the flexibility and scalability needed to grow sustainably without sacrificing quality or compliance.

Taking a look at investing data in the EU

Many traditional banks provide non-transparent and inflexible options – most of them mutual funds. With this gap in the market, people will go to fintechs that meet their needs. On top of that, investment in the EU market specifically lags behind the United States. This creates a perfect environment for building a digital wealth management platform.

Let’s take a closer look at these gaps:

- 15% of adults in the EU invest vs. 58% in the U.S.

- The wealthtech market in Europe is expected to grow at a CAGR of 14.7% from 2021 to 2028, reaching a value of $39.74bn by 2028.

- Banks are in a great position to take advantage of this untapped potential in digital wealth management by creating innovative user experiences

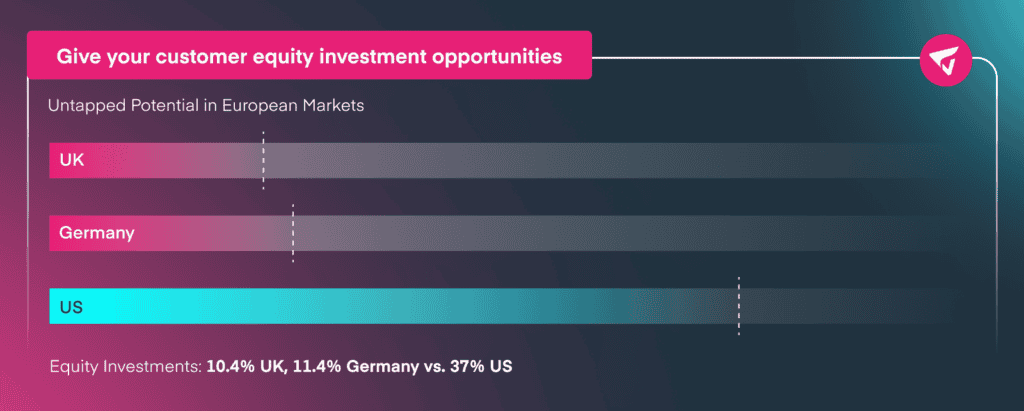

- In all of Europe, except Estonia, the share of household-held assets invested in equity is far below 50%. In the UK, that number is only 10.4%, 11.4% in Germany, and 22.2% in France. In the US, that share is around 37%, highlighting a significant difference in wealth management.

- Overall, a minority of Europeans invest in the stock market. Data shows that only 33% of UK citizens and 15% of Germans do so, showing sensible differences compared to the 55% of Americans in 2021. However, especially in the last two years, the number of people investing in the stock market is slowly increasing, particularly among those under 30.

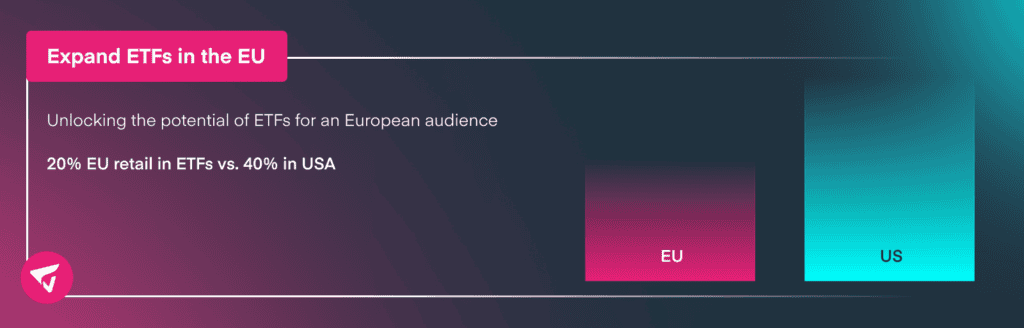

- The ETF market in Europe is primarily dominated by institutional investors, rendering it hardly accessible to retail investors. Only 20% of retail investors invest in ETFs, compared to 40% in the USA. This highlights a significant opportunity for retail-focused investment platforms, as ETFs are considered an excellent product for this market segment, offering lower fees compared to mutual funds and no commission fees bundled with distribution and advisory.

Read more of the study one the state of investing in the EU here.

Why is digital wealth management important?

Overall, building a digital wealth management solution can be simple, yet transformative: a digital-first investing app designed specifically for retail customers. This can bridge the gap between antiquated mutual fund approaches and contemporary wealth management strategies.

In an era where consumers expect instant access, personalized services, and seamless digital experiences, traditional wealth management models are falling short. Digital wealth management isn’t just a technological upgrade in the current market, it’s a fundamental shift in how investment services are delivered, accessed, and experienced.

By building a digital-first investing platform for retail clients, banks can tap into an underserved market and move beyond outdated mutual fund models and in-person advisory services. Digital wealth management makes investing more accessible, intuitive, and aligned with modern user expectations, bridging the gap between legacy products and today’s demand for real-time, goal-based, and data-driven solutions that support clients at every stage of their financial journey.

More importantly, the transition to digital can be both simple and transformative. With the right infrastructure and partner, banks can launch sophisticated digital offerings in months, not years, while staying fully compliant and secure. The result is a more inclusive, agile, and forward-looking model of wealth management that positions your institution as a future-ready financial partner.

What are the main functions of wealth management platforms?

Digital wealth management platforms are designed to help financial institutions offer comprehensive investment and advisory services to their clients in a streamlined, digital environment. Their core functions include portfolio management, financial goal planning, risk assessment, asset allocation, and performance tracking. In addition, modern platforms often support client onboarding, KYC/AML compliance, and automated rebalancing making them a one-stop solution for delivering both personalized advice and scalable investment strategies. With the rise of digital wealth management solutions, these platforms are evolving to meet the expectations of a new generation of investors seeking accessibility, transparency, and real-time insights.

You can learn more about the behind the scenes if you talk to our experts, check out our page dedicated to digital wealth management solutions here to learn more.

How do wealth management platforms offer these services?

Generally, wealth management platforms deliver their services through a combination of automation, data analytics, and intuitive user interfaces. And now, by using AI-powered tools, they can analyze client data to generate personalized investment recommendations, monitor portfolio performance, and manage risk dynamically. Automation handles routine tasks like account setup, goal tracking, and portfolio rebalancing, while clients benefit from self-service features and digital touchpoints that enhance engagement. In the context of digital wealth management, these platforms are built to integrate seamlessly with banking infrastructure, enabling institutions to offer tailored, compliant, and scalable investment services without the traditional overhead of manual advisory models.

What are the downsides of digital wealth management?

While digital wealth management brings scalability, cost-efficiency, and accessibility, it’s not without challenges. As with everything in the digital age, one downside is the potential loss of human connection. Some clients may still prefer face-to-face guidance or nuanced conversations that digital tools can’t fully replicate. Also, building a solid digital platform requires upfront investment in technology, security, and regulatory compliance. There’s also the risk of over-reliance on automation, which can miss complex edge cases or emotional factors in financial planning. Lastly, customer trust and data privacy remain critical concerns, so any breach or friction in the user experience can lead to challenging situations. However, with the right balance of tech, experience, and human insight, these challenges can be effectively managed. The first step is building your solution from the ground up with the right knowledge and expertise.

If you are curious to learn more, read the full guide on wealthtech here.