Galgal builds a user-friendly banking app with Vacuumlabs in just eight months

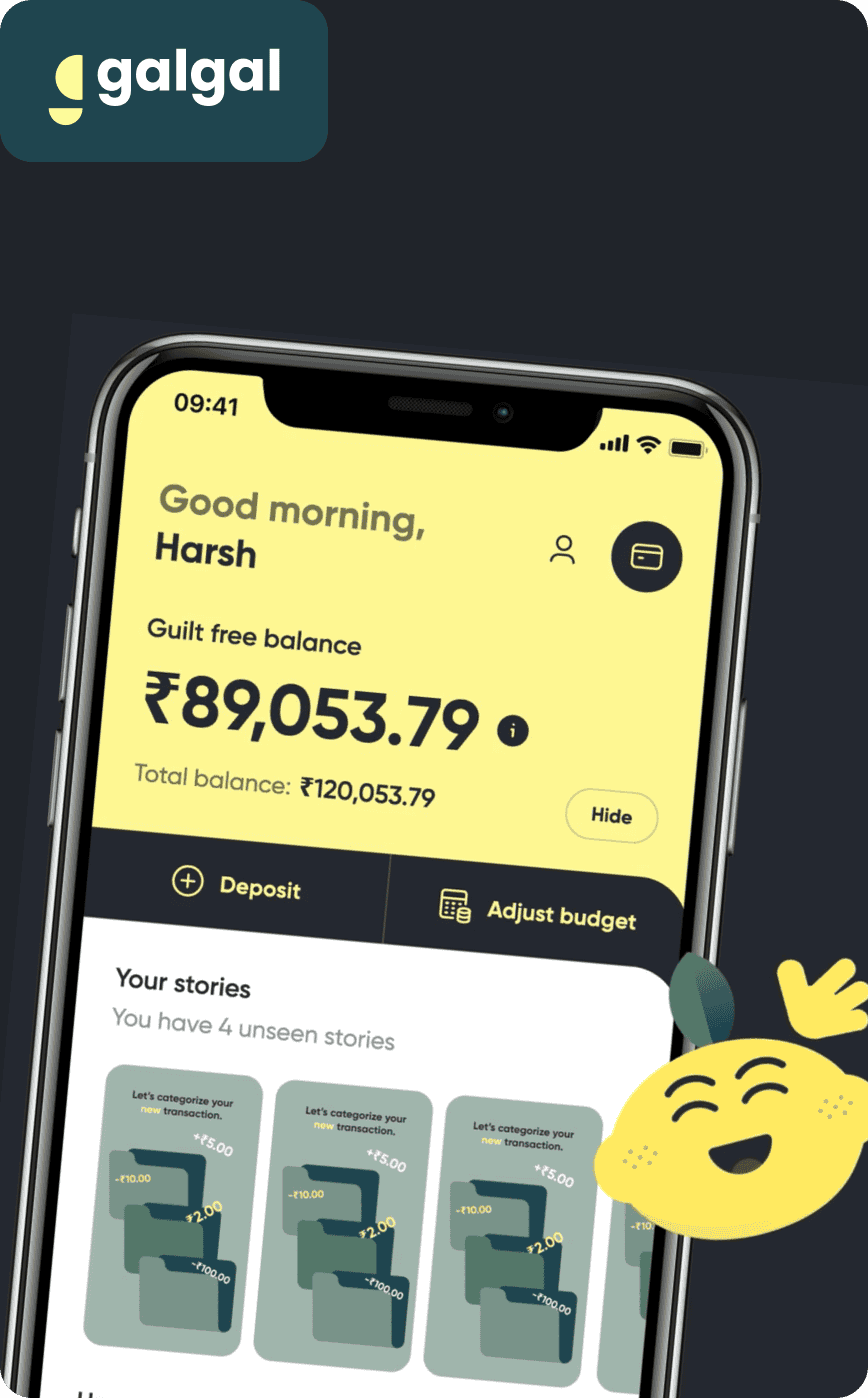

Does it feel challenging to manage your money efficiently? Galgal is a fintech startup based in Mumbai, India, that focuses on bringing efficient banking solutions to youths. The Galgal app was developed to simplify money management and make saving as stress-free as possible. By notifying users when they overspent or underspent, Galgal encourages young people to use money well and feel good about their accomplishments. Having Vacuumlabs as a partner has expanded Galgal’s potential and the app is now ready to impact the market.

Vacuumlabs, together with the Galgal team, built a new banking app to help the youth in India manage their finances. We worked with Galgal from the inception of the idea to building, providing end-to-end development.

Already enrolled on the waitlist

To develop the app

Calibrated a tx engine for the Indian market

In 2017, Galgal founder and CEO Harsh Chhatrapati conceived an idea to kickstart a fintech solution while he was still studying finance at the Imperial College Business School in London, where he saw firsthand how money matters impacted younger folk. His aim—helping young people in India save better. “Money management can be challenging for those who just started working. People get frustrated when they see a massive difference between what they want to save and what they can actually achieve,” says Chhatrapati. “I decided to build a stress-free solution that could change banking for the youths in my country and simplify money management for all. Our name, Galgal, is a type of lemon in India–it represents our mission to help youths squeeze more out of their money.”

I decided to build a stress-free solution that could change banking for youths in India and simplify money management for all.

Founder & CEO at Galgal

AWS infrastructure

React Native frontend

Clojure backend

In 2021, Chhatrapati mapped the target group to perfectly tailor his solution to future clients’ needs. He found that people aged 18 to 25 wanted to budget, save, and invest, but didn’t know how to consistently do that. Galgal then partnered with Vacuumlabs to realize the banking solution. “Vacuumlabs’ track record speaks for itself. They have worked on numerous successful fintech solutions, so I felt confident choosing them as our partner,” says Chhatrapati.

Together with Vacuumlabs and Arun Iyer, Co-Founder and Chief Product Officer at Galgal, Chhatrapati decided on each feature of the new solution and validated it with future customers. The process led to a three-month design sprint with Vacuumlabs and a Mumbai-based design thinking and behavioral science agency called TinkerLabs. “We organized our research into a Money Journey Map that included researching the competition, gathering user insights via interviews, and analyzing these insights and the whitespace opportunities,” describes Chhatrapati. “We were very impressed by Vacuumlabs because they always wanted to dig deeper to make sure that we built a product that met the market’s needs.”

Vacuumlabs was crucial during this phase to ensure the feasibility, Galgal to ensure the viability, and TinkerLabs to ensure the desirability – these are the 3 interconnected parts of our innovative product.

Founder & CEO at Galgal

Neobanking has gained a lot of attention lately in India with many new players emerging; the time to market for the new app was essential. The Vacuumlabs team was instrumental in fast tracking Galgal’s journey. “Vacuumlabs is a true technology company. They never took us as clients and worked with a true partnership spirit. They were not only involved in our early research phase but also in product ideation, design and development of the mobile app” underlines Chhatrapati.

Vacuumlabs’ involvement also expanded to the technical part of the project – building the frontend with React Native and the backend in Clojure, all on the AWS Global Cloud infrastructure. The app was built in eight months, while the transaction analytics engine was built in three.

It wasn’t all smooth sailing, though; the initial integration with a local bank didn’t go through. Fortunately, everyone reacted quickly and found another bank to integrate with. “The Vacuumlabs team did a lot of research on the Indian market to understand the context of the solution. Their quick response in making needed changes was also essential for our time to market,” recalls Iyer.

Building a transaction engine for a specific country was challenging. Vacuumlabs data science team calibrated a transaction engine for India, allowing the model to train itself and classify purchases based on country-specific retailers. As a result, the user can manage the budget by seeing their spending split into three categories: essentials, rainy days, and guilt-free. “Users can choose which category they want to track, and the app can provide exact figures on their expenses under those categories,” says Chhatrapati.

The Galgal banking app aims to represent a hyper-personalized advisor that makes banking stress-free for any user. It does this by nudging users into making the right financial decisions and changing their spending behavior. “The app sends a notification to users when they’ve overspent or underspent and encourages them to stay on track. This nudge theory makes it much easier to know your spending habits, which is less stressful than calculating it from a bank statement,” explains Chhatrapati.

It’s not just about savings—users can see how much is in their guilt-free money category when they’ve saved a certain amount and paid for essentials. “This way, they can buy something nice and be rewarded for working hard on achieving lifestyle goals,” says Chhatrapati. By establishing an emotional connection between the user and their budget, all money-related operations become more sustainable in the long run.

Galgal has already reached 5,000 users on the waitlist before its launch and is ready to be a trusted finance partner for young people all over India. “The app will also come with a prepaid card offering, which is Visa-powered and will offer credit-free payment options. This will better ensure users can avoid overspending and have a stress-free budget planning experience,” says Akshay Kapoor, Chief Marketing Officer at Galgal.

“The partnership with Vacuumlabs works very well because we are always in sync regarding what we need,” says Iyer. Galgal plans to continue its partnership with Vacuumlabs and is already discussing a future roadmap and new business development opportunities. “Through our partnership, both our engineering teams are working closely together now. With Vacuumlabs, we have shortlisted a few things that we want to work on after the launch to improve the customer experience and bring more innovative features that no one has built in India until now,” he reveals.

The partnership with Vacuumlabs works very well because we are always in sync regarding what we need.

Co-Founder and CPO at Galgal

Our team of experts will work closely with you to understand your goals and deliver a truly customized solution that meets your unique needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

Retail Banking

B2B Banking

Fintech and Neobanks

Product

Engineering

Operations

Latest Whitepapers

Interested in a specific topic?

Let us know - we are happy to help

Thank you for contacting us! One of our experts will get in touch with you to learn about your business needs.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You can also "Reject All".

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |