Advance Intelligence Group, a leading financial group focusing on BNPL, consumer financing and AI-powered products and services in Asia and Vacuumlabs expand access to banking with a new full service bank

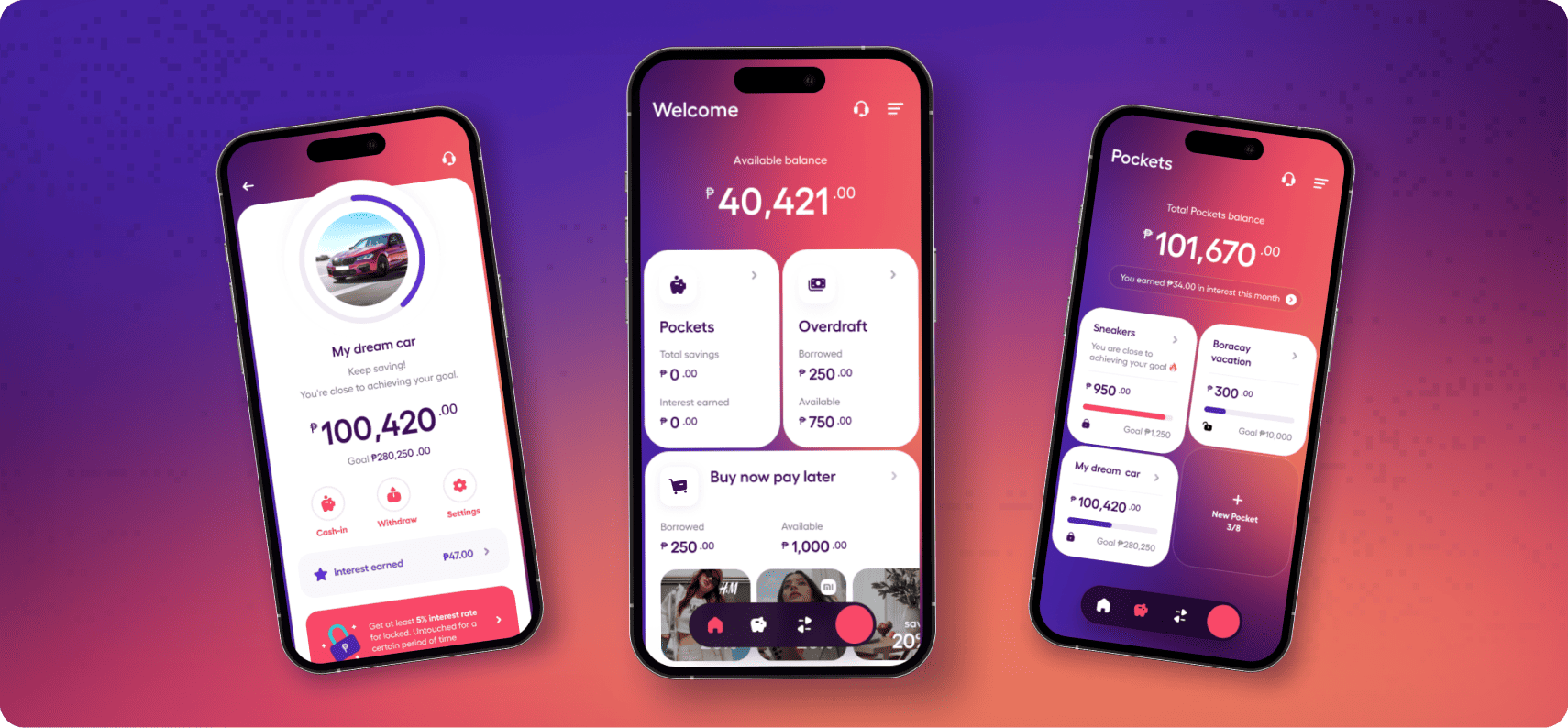

Digital Bank in the Philippines was designed to democratize access to financial services. Vacuumlabs’ team led this end-to-end product working in 8 squads and supported by senior level talent in design, product, engineering, architecture and program management. They built a fully fledged greenfield bank with a suite of features comparable to that of long-standing competitors.

Vacuumlabs lead the end-to-end project using 8 squads of senior-level design, product, engineering, architecture, and program management talent. The result is a fully-fledged greenfield digital bank offering a suite of features comparable to long-standing competitors

Each aligned by bank domain

To build a full service bank

From Vacuumlabs in the product teams

Based in Singapore, the Advance Intelligence Group is focusing on BNPL, consumer financing and AI-powered products and services, and provides a diverse suite of financial products and services across Southeast Asia. In 2022, the Advance Intelligence Group set out to build a mobile-first, comprehensive, full-service bank, Digital Bank in the Philippines, for the Filipino market to democratize access to financial services and fill the needs of a wide spectrum of customers, from the underbanked to regular bank users. “In the Philippines, 70 percent of the population does not have a bank account. The public perception is that only the rich can enjoy such services,” explains Vlastimil Hrabal, Director for the Digital Bank at the Advance Intelligence Group. “We wanted to establish a new normal and expand access to banking without differentiating customers based on their salaries, status or location.” The bank was designed around the values of safety, simplicity, and security. Digital Bank believes that everyone can improve their financial health and deserves access to top quality customer care.

The company needed a reliable partner with experts in building fintech products from scratch from discovery to implementation. “We had long, complicated discussions with a number of vendors,” recalls Hrabal. “Then something clicked with Vacuumlabs—we had a very straightforward conversation and they promised to support us all the way.”

The Vacuumlabs team was excited for the opportunity to create something that had the potential to positively impact the financial well-being of millions, leverage their experience building banks and financial service solutions, and put to use their unique expertise in Thought Machine’s core banking system – Vault.

Eight squads, aligned by different bank domains, composed of up to 90 experts from Vacuumlabs, launched into building a product from scratch. Vacuumlabs led the product, design, and engineering efforts and supplied the program management to oversee the entire endeavor. The team also incorporated Digital Bank in the Philippines’ in-house developers to ensure a smooth transition and success at later stages.

The first step was product discovery, taking the team through a flurry of quantitative and qualitative research and testing. “It was hard for us to explain the specifics of the local environment,” shares Hrabal. “Thankfully, Vacuumlabs arrived in the Philippines, explored the market, and really understood the needs of our users.”

“Building a fully functioning bank from the ground up came with some challenges. There were over 20 different 3rd parties to integrate, hundreds of user flows to implement, and a large team to keep efficient. Our solution was to split the bank into bounded contexts, map features to them, and assign squads explicitly to one or more of the bounded contexts. Each team maintains their own set of microservices, so that the deployment lifecycle of individual teams is independent and more efficient.”

Tech Lead at Vacuumlabs

Some of the biggest challenges of the project were tight deadlines, a complex network of over 20 third-party solutions that needed to be integrated with the product, and poor connectivity throughout the country. “Telecommunication infrastructure is very limited in most areas,” says Ion Mudreac, Chief Technology Officer of Retail and Digital Bank at the Advance Intelligence Group. “We wondered, how do we provide outstanding service without making our customers wait several minutes for the page or app to load?”

After less than twelve months spent perfecting the wireframes, prototypes, mockups, and blocks of code, the team built a full-fledged suite of products. Using Thought Machine’s technology as a base for the bank’s financial services and products, the Vacuumlabs team developed numerous microservices, integrations to 20+ third-party solutions, smart contract development, a mobile customer application, and a web application for bank users. All of these represent the foundation of a full digital bank portfolio: customer onboarding, accounts, transactions, cards, and two loan products.

To ensure scalability, the team went for a microservices architecture where building blocks can be changed without affecting the rest of the system.

Mobile applications for consumers; web applications for bank operations staff.

Features include a current account, two types of saving accounts, debit card, and two loan products.

Full scale of all types of transactions.

Base for the loyalty program.

“I love the product, it’s exactly what we wanted, and sometimes even better than what we were expecting. We have received positive feedback from focus groups and investors,” says Hrabal. “It’s simple and unique, offering the fastest onboarding experience in the local market. Most transactions only need a handful of clicks. Customer support is only one tap away, sharing all the necessary information with the operators to streamline our service. Simplicity is very important if we want to build financial and digital literacy.”

For Digital Bank in the Philippines, the key to its success is synergy. “Vacuumlabs managed to facilitate a very positive collaboration and build trust with open dialogue,” notes Mudreac. “They brought their expertise and vision, which helped us understand the full context, view things with a long-term perspective, and move faster with a lot of experimentation.”

“The Vacuumlabs team was very mature and fully able to implement the entire project without any micromanagement. They really came to understand the local market, identify the right problems to solve, and translate those requirements into the product.”

Chief Technology Officer, Retail

and Digital Bank at the Advance Intelligence Group.

As Digital Bank in the Philippines waits for the regulatory green light to start serving its customers and for a more favorable time for the banking market, it continues to rely on the fruitful partnership and even considers leveraging Vacuumlabs’ expertise in cryptocurrencies. “Month by month, we want to launch new features and products to make the lives of our users easier,” says Hrabal. “We don’t want to use technology for technology’s sake,” concludes Mudreac. “All we care about is creating the biggest impact and value, and technology is our biggest enabler.”

Thought Machine

Microservices: Kotlin + Spring

Kafka event streaming

Flutter

IaaC via Terraform

Our team of experts will work closely with you to understand your goals and deliver a truly customized solution that meets your unique needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

Retail Banking

B2B Banking

Fintech and Neobanks

Product

Engineering

Operations

Latest Whitepapers

Interested in a specific topic?

Let us know - we are happy to help

Thank you for contacting us! One of our experts will get in touch with you to learn about your business needs.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You can also "Reject All".

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |