European adoption of Buy Now, Pay Later apps reached a record 10 Million Installs in H1 2022 according to The Financial Brand.

The BNPL industry in Europe is on a meteoric rise, projected to reach a staggering €300 billion by 2025.

78% of consumers surveyed by The Financial Brand say they would use BNPL financing options from banks.

Hours of our research summed up in one convenient webpage

A showcase of the innovation and potential in the BNPL space

Expert high-level architecture and UX visualizations by our delivery teams

No strings attached and no downloads necessary

Leave us your email and we will send you the highlights in a handy PDF.

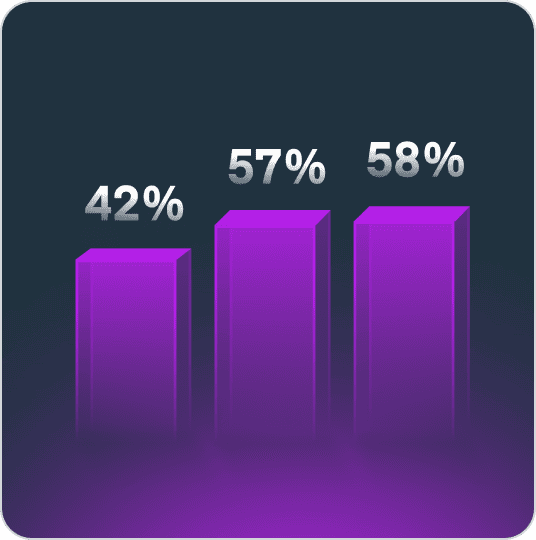

A study from Citizens Advice shows that 41% of BNPL consumers struggle to meet BNPL repayment and in 57% of the cases, creditworthiness assessments were not performed when applying for European BNPL products. Banks have a competitive advantage here, since they are well versed in assessing risks.

Most non-bank BNPL providers have been providing incomplete, if any, information to nationwide consumer reporting companies. New BNPL providers must report this positive data to support consumer financial health.

Many consumers trust their existing financial institution more than BNPL providers. 78% of consumers surveyed by The Financial Brand say they would use BNPL financing options from banks where they already have account relationships.

Banks have a competitive advantage with BNPL. They are well versed in offering credit with safer terms. This presents a great opportunity to build new, successful BNPL products by leveraging their established reputation, existing users, and built-in functionalities (credit assessment, payment in physical stores, overview of accounts, etc).

We rounded up several expert surveys of 1,000s of credit card and BNPL users.

The demand for something beyond a credit card is apparent.

In a 2022 survey of BNPL users – 58% of US respondents, 57% of Australian respondents and 48% of UK respondents, said they preferred BNPL over credit cards.

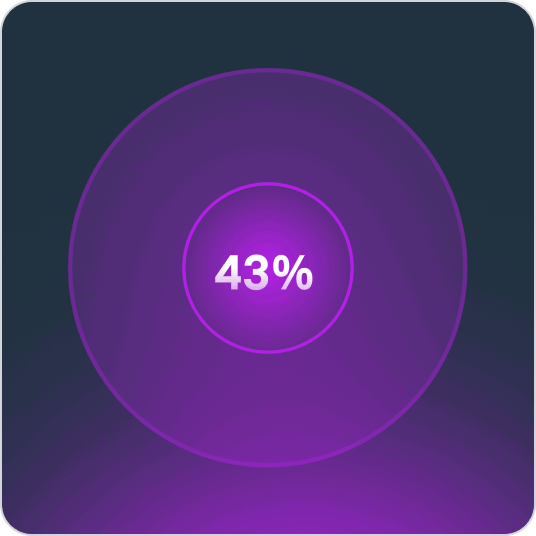

In a survey of credit card users, 43% of credit card debtors don’t know the interest rates of all of the cards on which they carry a balance.

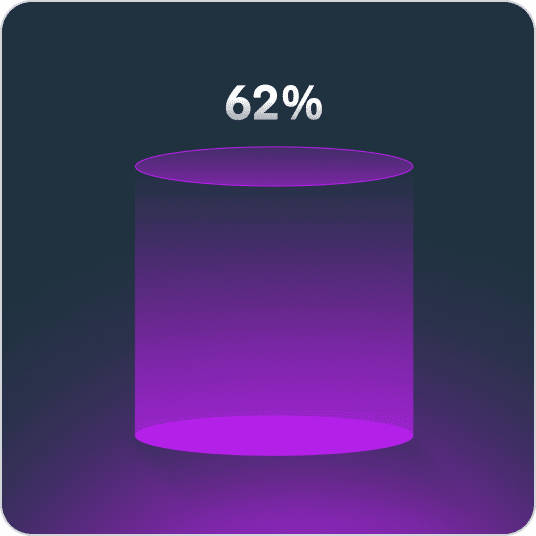

62% of consumers surveyed by Experian think there is probably a better credit card for their needs than the one they are currently using.

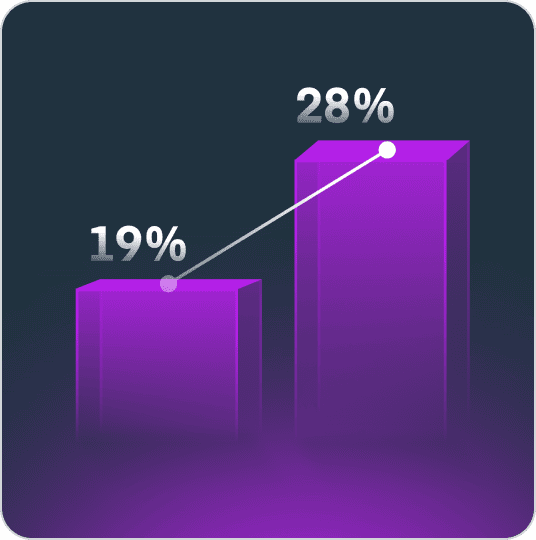

Embedding BNPL in bank credit cards could increase credit utilization in Europe from 19% to 28%.

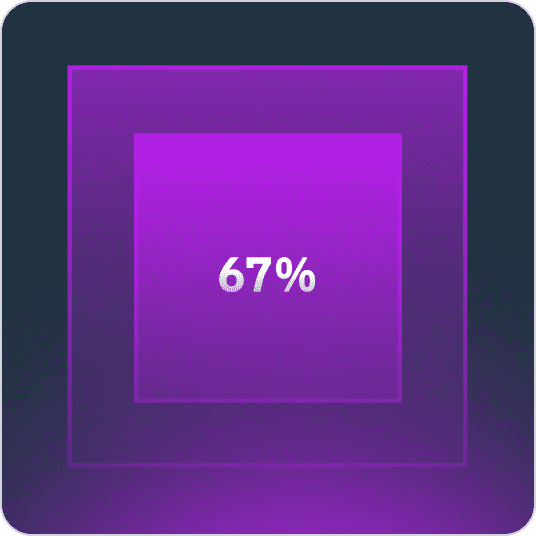

67% of people surveyed believe BNPL will replace credit cards.

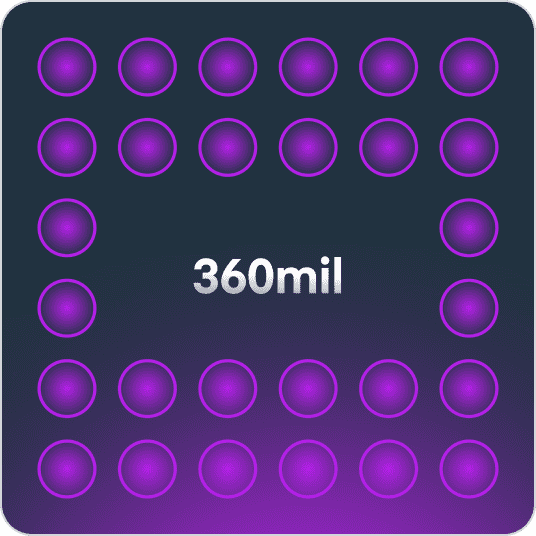

As of 2022, an estimated 360 million people worldwide use BNPL.

The data shows a need in the market for something beyond credit. BNPL products are a great opportunity for banks to improve their current options for instalment payments with better user experience and new features that are more adapted to people’s lifestyle and needs.

Just leave us your contact and our experts will get back to you soon.

Who are the potential users of BNPL by banks? To get better insight into the market for this product idea, we prepared an overview of the Mastercard report “A closer look at who is using instalment financing” based on research conducted in 2022.

Analyzing the current user trends in instalment financing, we can begin to get a picture of the potential users of BNPL product built by banks and see that it’s the younger generations driving this growth in instalment financing – making this a great bet for the future.

Innovative banks are already offering BNPL to their customers. Here’s some inspiration from around the world.

Citibank: Citibank offers a BNPL solution called Citi FlexPay, which allows users to split eligible purchases into 3 or 6 instalments with no interest. Users can apply for Citi FlexPay directly through the Citi app or online banking platform.

Chase: JMy Chase Plan® is a BNPL feature offered in certain Chase credit cards. With an eligible Chase credit card and My Chase Plan, you can break up card purchases of $100 or more into equal monthly payments.

U.S. Bank ExtendPay lets users pay down purchases of $100 or more with fixed monthly payments and no interest for a set repayment period. Instead of interest, U.S. Bank ExtendPay charges a small, fixed plan fee.

Monzo: With the Monzo Flex Credit Card, users can pay in full on their next payment date or in 3 monthly payments at 0% interest. If more time is needed, they can charge 29% APR representative (variable) for up to 24 monthly payments.

Santander Pay in 3: Santander provides a BNPL solution called Santander Pay in 3, enabling users to choose a purchase made with Santander credit card, and pay it off in 3 instalments. User can split purchases of up to € 1,000.

HSBC’s Easy Pay allows credit cardholders to convert their purchases into affordable monthly installments with competitive interest rates. Customers can enjoy flexible repayment terms.

MOX: The Hong Kong-based digital bank Mox, developed in partnership with Vacuumlabs, has introduced a new Buy Now, Pay Later via its Mox Credit product, called “Split purchase.” The instalment period can range from 3 to 36 months.

Bank Australia: ANZ Instalment Plans is covered by the users existing credit limit, meaning there’s no need to apply for additional credit. They can choose an eligible purchase to put on the Instalment Plan (3, 6 or 12 months).

DBS Bank Singapore: With My Preferred Payment Plan users can consolidate and convert up to 10 eligible transactions into monthly instalments of up to 24 months. It’s instant and convenient – through a digital bank.

ICICI Bank India: ICICI Bank offers an “Instalment on Call”, where users can split a big amount into small affordable instalments for a tenure ranging from 3 to 24 months. Instalments are charged monthly as a part of their Credit Card Statement.

There are a few notable BNPL providers on the market. What would make this product different when built by banks? We prepared a side-by-side comparison to clarify differentiators for BNPL offered by banks.

Credit cards have bad reputation. Pure-play BNPL is imperfect. The creation of a simple to use product that delivers a good experience can attract new users and engage your existing customers.

Would you like a PDF version for easy reference? Just leave us an email and we will get it to you ASAP.

Analyzing the market, product opportunities and user needs in the current landscape, we outlined two unique product approaches that can help banks shape their BNPL and credit propositions.

The aim is a BNPL product offered by banks, with flexible payments and no merchant dependency. Users can make purchases with their credit line in online and offline stores – and manage their repayments through the app, straightaway. They can select the amount of the instalments for the each specific purchase – different from most of credit cards, that just allow the purchase management in a bundle, not transaction by transaction.

How can a bank go about building a BNPL product? Below is a simple comparison of two different approaches and their advantages. As a bonus, our engineering team prepared high-level architecture diagrams so you can see the inner workings of each approach.

Banks can leverage their existing infrastructure, such as credit card processing systems and customer service channels to offer instalment cards within existing card products. This can reduce the costs associated with launching a new product.

Integration with existing card platforms and systems may be smoother, leading to a faster time to market.

Banks can cross-sell instalment cards to existing credit card customers, which can help to increase customer loyalty and revenue. This can be particularly effective for consumers who may not be aware of or qualify for traditional BNPL options.

Instalment cards that are part of an existing card product may be subject to less regulatory scrutiny, as they may be considered extensions of existing credit card offerings. This can simplify regulatory compliance efforts.

Banks can create a dedicated product tailored specifically to customers looking for BNPL services, ensuring that the offering aligns perfectly with this segment’s needs.

A standalone app enables marketing efforts exclusively on promoting the BNPL card, reaching a wider audience of consumers seeking this particular financial service.

Banks can develop unique features and rewards specific to the BNPL card to attract potential users and keep them engaged.

Banks have complete control over the terms and conditions of the instalment card, including interest rates, fees, and rewards. This allows them to tailor the product to the specific needs of their target market and ensure that it aligns.

Banks have two ways of building a new BNPL service – these ideas are outlined here and can be customized to each bank’s unique case.

Knowing your region is essential – each country will have its own unique challenges and opportunities – both in terms of legal requirements and market needs.

The product idea outlined in this guide can be further tested and customized. With robust product discovery, we can explore specific user needs, connect it to your existing financial products, design innovative features, and more.

It’s important to determine the best partner for your unique product and existing technological infrastructure. With us, you can explore enterprise-grade payment processing and ledger infrastructure for banks such as Episode 6, Thredd, and Paymentology.

Not ready to go all-in on BNPL? Consider other avenues of innovation in instalment financing: Improved credit card UX and guidance features, credit cards for niche groups, and building BNPL options directly into credit cards.

Leave your email in the contact form or reach out to one of our experts directly.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

By submitting this form you agree to the processing of your personal data according to our Privacy Policy.

Retail Banking

B2B Banking

Fintech and Neobanks

Product

Engineering

Operations

Latest Whitepapers

Interested in a specific topic?

Let us know - we are happy to help

Thank you for contacting us! One of our experts will get in touch with you to learn about your business needs.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent. You can also "Reject All".

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |