The Evolution of the neo-bank

The onset of digitalisation disrupted and forever changed countless industries and incumbents such as Kodak and Blockbuster. Up until around 2012, banks appeared to be immune from such disruption. However, around 2012 the rise of the neo-banks and unbundlers began.

There are countless drivers behind the rise of the neo-banks, but two important factors have propelled the rise. First, the opening up of the market for new entrants and further innovation by regulators.

In the UK, perhaps the epicentre of neo-banks and disruption, this was accelerated by the country’s forward-thinking regulators and countless Sandbox initiatives.

Second, the overarching one size fits all model of banking products. Customer segmentation was largely based on wealth (e.g. mass Market vs private vs. high net worth) or in the case of businesses, a simplistic classification by their turnover.

The first wave of the neo-banks was characterized by the Simples’ and Movens’ of the world, which aimed to differentiate from traditional banks in two ways.

First, a banking experience entirely and exclusively on mobile, and second by offering next-generation personal finance management (PFM) aimed at the masses, based on ‘safe to spend’ analysis and enhanced categorisation.

The next wave of neo-banks saw the launch, and subsequent catapult to Unicorn status, of N26, Revolut and Monzo. These banks continued with the mobile-first and great PFM approach as their predecessors, but also focused on external partnerships, marketplaces, beautiful design and most importantly, a low-cost option.

The new neo-bank

What does the neo-banking (or niche banks) scene of today look like? There is one key difference in how the new banks of 2018 and 2019 differ from their predecessors, and that is their focus on a specific customer segment with unique needs. Today, “mobile or digitally savvy” customers just aren’t a true specific segment.

The neo-banks of today, or niche banks, are continuing to build upon what Monzo, N26 and Revolut have achieved, but tailoring their entire product offering, design, and brand towards a particular segment.

This includes customer segments with particular beliefs, concerns, or ways in which they engage with technology. By going niche, a whole host of doors are unlocked in terms of offering truly contextualised, relevant and customer-friendly solutions.

Everyone reading this post is a bank customer, but how many of us feel that our bank is solving our unique pain points besides offering us the baseline financial products such as current account or a payment card?

What do the niche banks look like?

We will explore a few new niche banks, and demonstrate how they were created to cater to a particular niche. These banks cater to a very broad spectrum of customers and are fantastic examples of how their product vision resonates across every touchpoint of the customer experience.

TMRW Bank

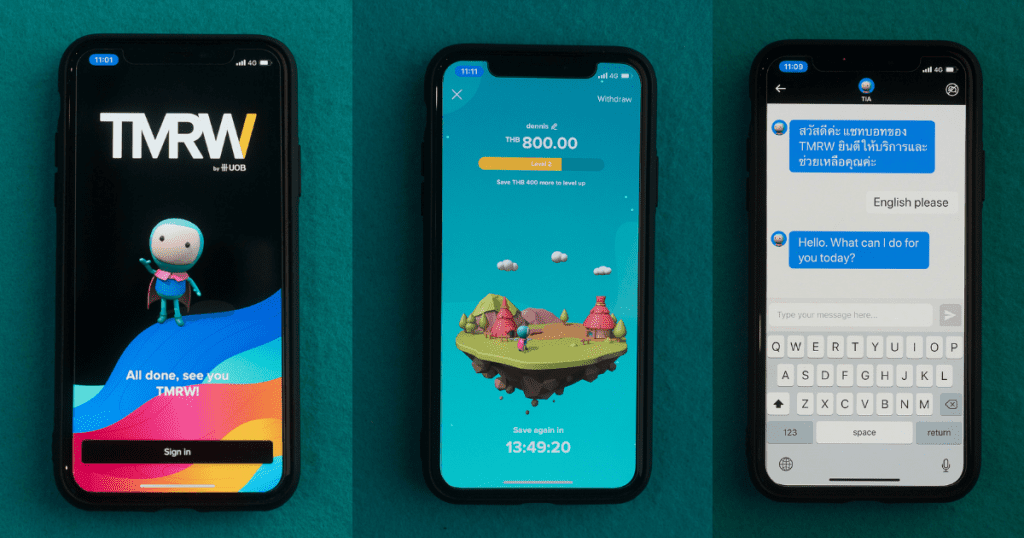

Let’s start with TMRW Bank, the digital-bank offered from UOB, designed for millennials in Thailand.

TMRW was built completely from scratch with the sole purpose of meeting the financial needs of ASEAN millennials. It is designed to cope with each distinct market and taps into the regional UOB Engagement Labs (unit set up by UOB bank to leverage behavioural insights to deepen customer engagement) in order to experiment and learn from potential customers.

The bank partnered with two fintech firms and learned from market leaders as well as millennial brands to explore the latest technological and behavioural insights to deepen customer engagement.

A handful of features are applicable to the millennial segment:

- Millennials prefer simplicity and engaging user experience and therefore the app does not have a traditional app menu, instead, the bank will learn from each customer’s usage to bring upfront functions and information that is personalised to their needs

- Taking reference from popular messaging apps, TMRW is the first digital bank in the world to feature a call function within its digital chat service

- Millennials respond better to prompts that are fun and do not make them feel guilty. TMRW has a distinctive gaming feature in its approach to money management, where customers build a virtual city that gets bigger as their savings increase. According to UOB, the game quickly became one of its customers’ favourite features because it helped them meet their savings goal whilst being fun and engaging.

- Other useful features built into TMRW include transaction insights and travel summaries of users spending

- TMRW’s app eliminates the use of banking jargon for a simpler and more engaging experience, the result of ethnographic research on millennials conducted by UOB before it launched TMRW

TMRW is a fine example of engaging customers from the onset of the build and translating every feature, design component, and usability based on the results of those engagements.

Insha

Insha is a digital bank offered by Bahrain’s Albaraka Turk and powered by Solaris Bank. It was launched in Germany, with plans to extend into other parts of Europe. It is the second bank in Germany to manage the money of its customers according to the rules of Islamic Banking (there are 20 million Muslims in the EU and 4.7 million Muslims in Germany). Adherence to Islamic Banking principles is the key driver behind how this bank fulfils the needs and value of its target customer segment. Insha cleverly explains their relational with the following question:

“If you can choose your meals according to your values, why wouldn’t you be able to choose your banking according to your values?”

What’s applicable to customers who wish to bank according to Islamic banking principles?

- Interest-free banking principles

- No investments in alcohol

- Although the app is available in German, it caters to individuals whose mother tongue may not be Germany. For example, users can choose between German Turkish and English.

In addition to a bank based on Islamic principles, it has a Mosque finder and Zakat Calculator (Zakat is a payment made annually under Islamic law on certain kinds of property and used for charitable and religious purposes). Furthermore, it includes all the nicely designed and convenient features one would expect from a mobile-first bank, and it truly adheres to the fact it’s built based on values.

[related_article]

Tomorrow Bank

Tomorrow is a German bank, again powered by Solaris. It is a mobile-first bank with an ethos of living and banking sustainability, backed by it’s a sustainability promise. It utilises open discussions around how money can be part of the solution for a sustainable future.

Upon early customer testing, the team realised there was certainly a market for those looking for a bank that focuses on sustainability. Within the first 20 minutes of their first social media post, they had 150 applicants for testing.

What makes everything about Tomorrow sustainable?

- Finances renewable energy, organic agriculture, and microcredit projects

- Makes an active contribution to climate change when the credit card is used

- Uses an Impact Board that shows customers exactly where their money is working. For example, they can see how many trees have been planted thanks to their purchases

- Collates customer feedback and testing via the Tomorrow Forum, a 24/7 exchange about what Tomorrow should look like technically, ethically and organisationally

- They are currently working towards certification as B-Corp, a special designation for ethical businesses

Tomorrow features and design meet a highly transparent and truly passionate bank about sustainability. Every part of this bank resorts back to its values and sustainability.

Why these banks matter

Atom Bank, one of the early UK neo-banks launched their app with the promise of providing a truly personalised banking experience. When customers registered, they could choose their “unique” colour pallet for their banking app and ‘rename’ the bank based on their name (for example, my bank would be “The Bank of Matej.”).

Kudos for what they were trying to achieve but nothing about these features constitute a banking experience truly tailored to an individual.

Today, we are on that path toward establishing greater personalisation in financial services. While this may never get to the individual level, we are starting to see more solutions focusing on particular nuances of segments, or tailored to specific beliefs or requirements.

It goes above and beyond the most obvious way to personalise banking experience by implementing machine learning or AI capabilities. In our opinion, it’s a fantastic way forward.

By deeply aligning their purpose, vision and brand around a particular niche, these banks can capitalise on actual jobs in their customers’ daily lives, potentially catering to more touchpoints than traditional banks can who simply add some incremental technology to ‘personalize’ their platforms.

With the rise of banking-as-a-service providers and vendors available to build a bank, there is an unlimited opportunity for going niche for startups and incumbent banks alike. In the second article of this series, we will explore where some of these opportunities may lie.