Brano Vargic from Home Credit Vietnam had an interesting discussion with Marcel Klimo on the latest episode of our weekly podcast series, Banking on Air. He talked about his excitingly developing career path as well as the characteristics of the digital payment market in the Southeast Asian region.

Brano has been part of the HR field for almost 15 years. He worked with the global consulting company, Hay Group, where he focused on issues like leadership compensation. Later on, he joined Tatra Banka, part of the Raiffeisen Group, as the Head of HR.

Afterward, he got approached by Home Credit which offered him a COO role in the Vietnam branch, that he just couldn’t say no to. Therefore, he and his family moved to Vietnam to start a new adventure.

‘Everything surprised me. I didn’t know what to expect but the booming growth of the economy was the first shocker. Until COVID happened, the Vietnamese annual GDP growth was around 7%.’ – Brano Vargic

How to make reliable customers

Home Credit is essentially a consumer finance company with different business units worldwide. The unit Home Credit Vietnam is a non-banking institution with a relatively simple business model providing three lines of services:

- Classical installment programs

- Short term loans

- Credit cards with different features and cashback programs

‘We have a vast knowledge of underwriting processes, which in other words means that we are able to analyze customers’ behavior and predict how disciplined they will be in terms of paying back.’ – Brano Vargic

The key to success: moving forward

Home Credit Vietnam is keeping with technologies at breaking speed. It launched a voice bot service 3-4 months ago. They are replacing humans with machines on relatively standardized calls. We can hear a voice that essentially sounds like a human and the AI system is learning from the scenarios continuously.

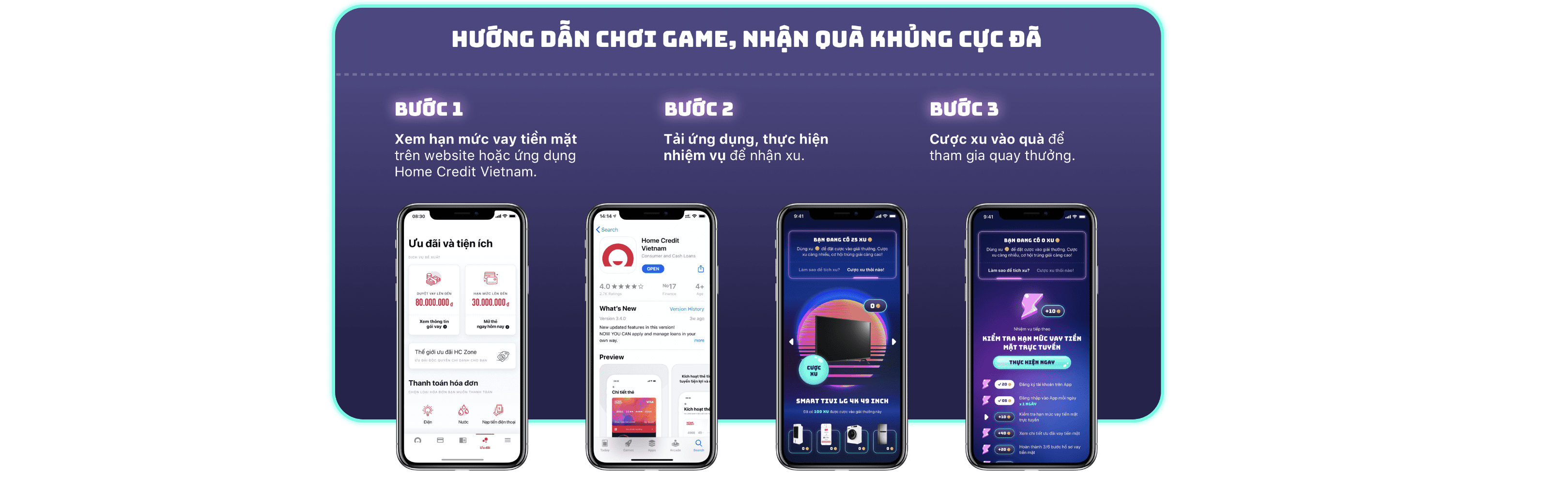

In 2021, they are also planning on launching a chatbot and adding some gamification or marketplace to the app that would attract larger traffic.

‘Gamification is a huge part of your branding and of how you get them interested in coming into your mobile space, your mobile application.’ – Brano Vargic

3 cross-continental market differences to consider

According to Brano, there are many differences on the Southeast Asian market from the EU market, he mentioned 3 big characteristics he observed:

- Size of the market

- Level of digitalization

- The ecosystem of digital payments

‘In Vietnam there are almost a hundred million people, that enables you to have a much greater impact and address a more significant portfolio of clients.’ – Brano Vargic

Home Credit Vietnam has between 2-2.5 million active customers on average – that is like having an entire larger European city as customers.

The expected level of digitalization is higher on the market, customers want to apply for a loan on their mobile phones or other devices. If someone owns the transactions or knows what the customers are spending money on, they are able to get into the lending business and the ecosystem of digital payments.

‘The financial sector very much reminds me of the financial sector in Central Europe, somewhere around 1995 to 2000, right before the banks were privatized. Retail banks have relatively old systems and are not so flexible in terms of digitalization. But the main difference between the mid to late 1990s in Europe and here is the fact that we have the internet. And that has created in Vietnam a relatively vast economic space into which many players jumped in.’ – Brano Vargic

Learn about the biggest players on the market

Based on Brano’s personal experience, Asia is ahead of Europe in the area of digital payments with the spread of the so-called super apps. Huge ecosystems of apps are trending on the market and there are massive rounds of investments and funding, supporting the new innovative solutions.

Sea Group is a Singaporean player who also runs the biggest e-commerce portal in Vietnam, Shopee:

‘Shopee is a combination of Amazon and eBay, not only merchants, but also private individuals can do their selling on the platform. And they have their own e-wallet called AirPay.’ – Brano Vargic

Grab is also a huge Singaporean player:

‘Grab acquired Uber in Southeast Asia two years ago. Grab today is a super app that has financial services, they have their own white-label e-wallet, they have a food delivery service, all within one app. – Brano Vargic

What about the financial service providers in the region?

‘There are many brand names in the world of e-wallets and digital payments, the biggest player in Vietnam is a company called Momo (mobile money). At the moment it has roughly 12 million registered users.’ – Brano Vargic

It seems like the biggest B2B businesses in the Southeast Asian region are all trying to cover financial services with their own e-wallet.

‘If you’re a B2B business and you have a well established mobile application, then sooner or later, you will get into the business of transactions. And I think that’s what everybody is after in the ecosystem of fintechs, how do we get our hands on the transactions?’ – Brano Vargic

The mystery behind innovation being ahead in the region

As mentioned before, the market size definitely plays a huge role in the rapid growth of innovative solutions. Also, Asians are very playful, they like the element of fun that contributes to their adoption to new features.

‘Somehow they see an element of playfulness behind those innovations. I think that Europe is a bit more conservative on that part.’ – Brano Vargic

However Vietnam skipped the era of the PC, the generation of the digital era is growing massively right now, it seems like the emerging new trend of super apps is closely tied with the growing number of internet users.

[cta_to_website]

Top recommendations for those who are planning on entering the Vietnamese market

If you would like to be present on the Vietnamese market, Brano suggests you to actually visit the region for a 3 months long period at least. Be prepared for a certain level of bureaucracy and be flexible at the same time – quick development and piloting is the key.

‘You need to transform your development to be even quicker than it is today and to be able to spit out things into the market and test them as quickly as possible. If it doesn’t work, throw it away, onto the next.’ – Brano Vargic

Brano says that you should see digitalization working on a daily basis with your own eyes to believe in its power.

‘Almost every morning when I walk to the office there’s an old Vietnamese lady in a typical Vietnamese hat standing with her little cart, selling Banh Mi, a Vietnamese subway sandwich. I’m not sure this lady is able to read, however, she has a mobile phone. And when I purchase my Banh Mi sandwich, the way that I pay to her is that she shows me a QR code on her mobile phone, I scan the QR code with my phone that automatically connects me to my e-wallet, my e-wallet is connected to my Vietnamese bank account at HSBC and within a millisecond the payment is done. And I say, ‘Cảm ơn’ [thank you very much], and I walk away.’ – Brano Vargic

2-3 years ago Brano would never have thought about owning eight different digital bank accounts, by now he became a big fan of innovative payment solutions. He finds the different features fascinating and loves to spend time on researching them. The big jump from the CEE region to Home Credit Vietnam definitely had a huge role in waking up his curiosity.

Banking on Air podcast explores the lives and journeys of founders and technology leaders as they work to overcome challenges while building products in an ever-changing world. This episode was hosted by Marcel Klimo from Vacuumlabs.

Listen to the original podcast episode on Apple Podcasts, Breaker, Google Podcasts, Overcast, Pocket Casts, Spotify, or here: